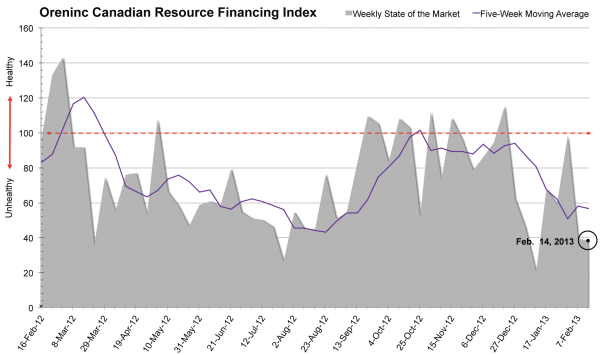

Oreninc Index Back Down

The Index is back down after a one-week hiatus while the Oreninc Team was in Toronto at PDAC. During the conference, our Managing Director Benjamin Cox presented on the “Capital Markets Crisis of 2013” at PDAC’s Annual General Meeting, which can be downloaded below.

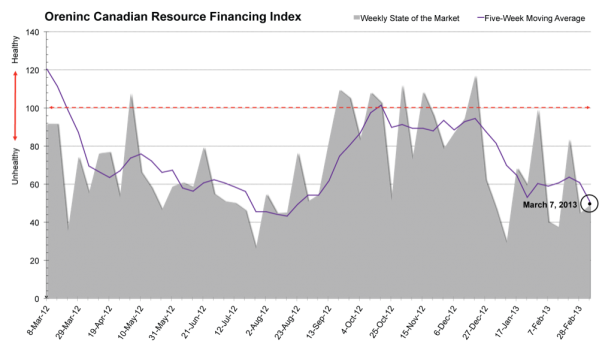

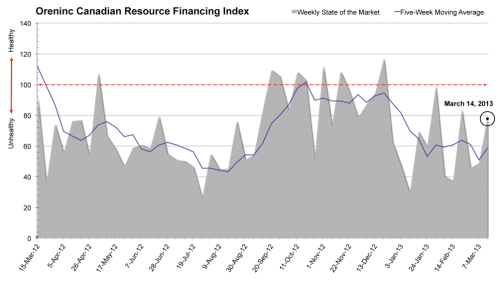

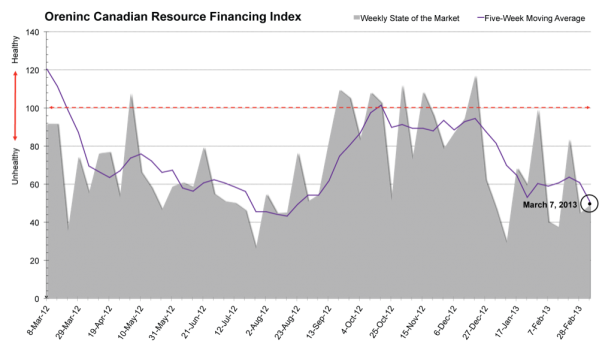

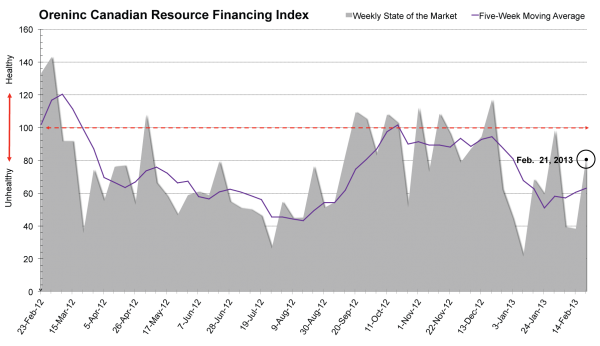

Following a rosier market during the week ending February 21st, the two most recent weeks, ending February 28th and March 7th, were considerably weaker. The two faltered in different ways. The week ending February 28th had an increase in total deals opened, however average deal size and total dollars announced fell significantly. In contrast, the week ending March 7 had the most brokered offerings announced since January, but total number of offerings was down. The tumultuous market seems to be heading with us into spring.