Oreninc Index Up During Holiday-Shortened Week

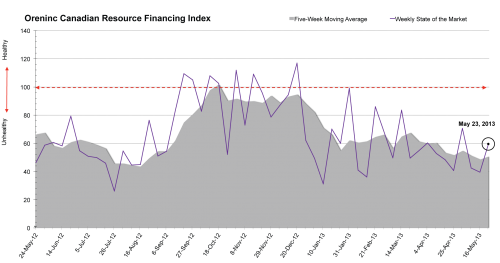

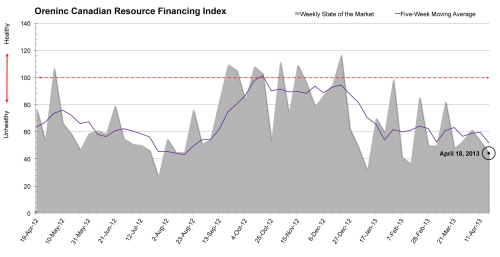

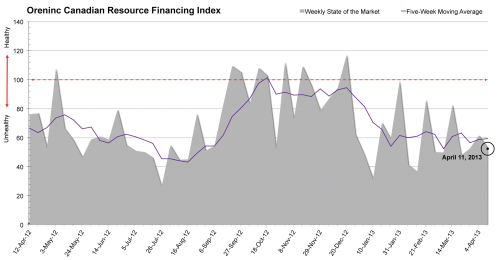

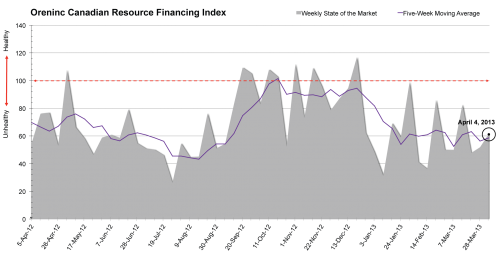

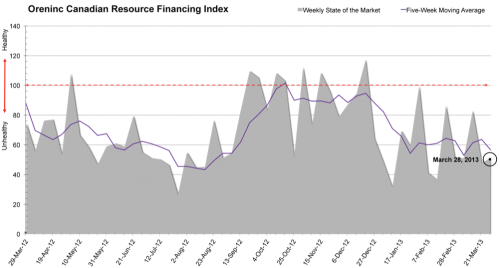

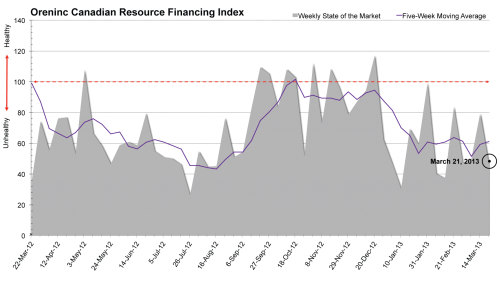

Note: The Oreninc Index image below has changed since indexes before May 2013. The weekly state of the market is now the purple line and the five-week moving average is the grey area.

The Oreninc Index climbed to a three-week high during the holiday-shortened week ending May 23, 2013. Total dollars announced was down while brokered dollars announced jumped to a three-week high and the second highest in seven weeks. Next week will likely be slow with market closures in the United States and United Kingdom.