Oreninc Index Update: April 11, 2013

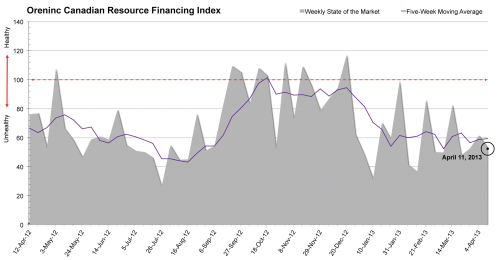

Oreninc Index Stumbles After Two-Week Climb

The Oreninc Index fell to a two-week low for the week ending April 11, 2013. Despite the total number of brokered and bought deals reaching a four-week high, the financing markets are clearly continuing to struggle. The recent drop in spot gold may increase concern regarding investing in gold properties--something that may drive the Index even lower given the significance of gold exploration within the Canadian resource financing market.

Summary:

- Deals announced climbed to 30, a three-week high.

- Five brokered deals were announced, a four-week high; brokered dollars announced fell to $33.9 million.

- Three bought deals were announced for $25 million, the most offerings in four weeks.

- Total dollars announced dropped to $82 million, a two-week low.

- Average deal size decreased to $2.8 million, a three-week low.

Major Financing Openings:

- Storm Resources Ltd. (TSX-V:SRX) opened a $29.29 million offering underwritten by a syndicate led by FirstEnergy Capital Corp on a bought deal basis. The deal is expected to close on or about May 1, 2013.

- Sulliden Gold Corporation (TSX:SUE) opened a $24 million offering on a best efforts basis. Each unit includes a 1/2 warrant that expires in 24 months.

- Alpha Minerals Inc. (TSX-V:AMW) opened a $12.28 million offering underwritten by a syndicate led by Salman Partners Inc. on a bought deal basis. The deal is expected to close on or about April 25, 2013.

- Sienna Gold Inc. (TSX-V:SGP) opened a $7 million offering underwritten by a syndicate led by Casimir Capital Ltd. on a best efforts basis. Each unit includes a 1/2 warrant that expires in 24 months. The deal is expected to close on or about April 30, 2013.

Major Financing Closings:

- Kelt Exploration Ltd. (TSX:KEL) closed a $94.35 million offering underwritten by a syndicate led by Peters & Co. on a bought deal basis.

- Anterra Energy (TSX-V:AE.A) closed a $7 million offering on a best efforts basis.

- Kivalliq Energy Corporation (TSX-V:KIV) closed a $4.54 million offering on a best efforts basis. Each unit includes 1 warrant that expires in 24 months.

- Nemaska Lithium Inc. (TSX-V:NMX) closed a $4.24 million offering underwritten by a syndicate led by Euro Pacific Canada on a best efforts basis.

Comments