The Oreninc Team exhibited at Metals & Minerals NYC earlier this week, on behalf of Aston Bay Holdings as well as Oreninc. Managing Director Benjamin Cox presented on "Base Metals" and...

The Oreninc Team exhibited at Metals & Minerals NYC earlier this week, on behalf of Aston Bay Holdings as well as Oreninc. Managing Director Benjamin Cox presented on "Base Metals" and...Index updates, Top 10 financings, Presentations, Partner updates and much more …

The Oreninc Team exhibited at Metals & Minerals NYC earlier this week, on behalf of Aston Bay Holdings as well as Oreninc. Managing Director Benjamin Cox presented on "Base Metals" and...

The Oreninc Team exhibited at Metals & Minerals NYC earlier this week, on behalf of Aston Bay Holdings as well as Oreninc. Managing Director Benjamin Cox presented on "Base Metals" and...The fact is that this downturn is not going to last and even Mick (Mick Davis, outgoing CEO of Xstrata) is figuring out how to position himself for the recovery.

I remember back when I had a real job sitting in a room with Mick and a bunch of angry shareholders, and someone (a fund manager) asked him to apologize for issues from 2008. He was defiant and just laid into the poor guy. He was right and the fund manager was wrong.

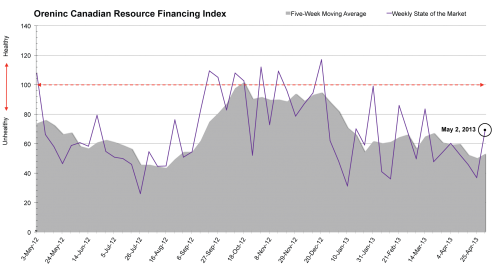

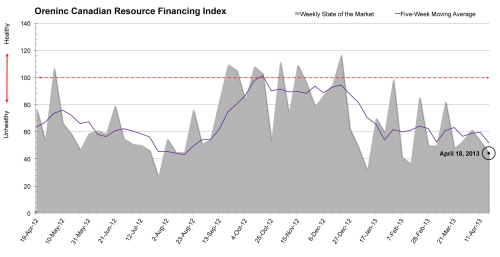

Note: The Oreninc Index image below has been inverted from previous weeks. The weekly state of the market is now the purple line and the five-week moving average is the grey area.

The Canadian resource financing markets continue to slump even as the Oreninc Index reaches a seven-week high during the week ending May 2, 2013. The major driver of this week’s Index was a single large offering. Had that offering not occurred, the week would have been flat. While it is nice to see large companies still being able to raise money, the Index bump is likely not a positive indication for mining juniors.

There used to be a website called F-ckedcompany.com. It kept track of the high tech companies that were f-cked and was full of rumors and gossip, and frankly was one of the best pre-Twitter gossip sites on the Internet.

I was addicted to it for a while, never posted, but read everything.

The Society for Mining, Metallurgy & Exploration is holding its first Current Trends in Mining Finance conference today and tomorrow in New York City. Our Managing Director, Benjamin Cox, will present...

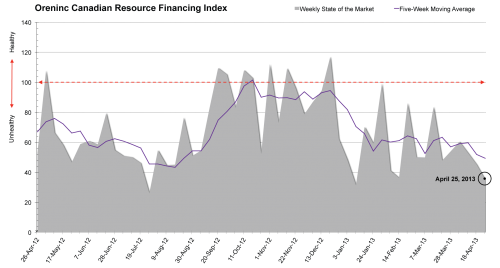

The Society for Mining, Metallurgy & Exploration is holding its first Current Trends in Mining Finance conference today and tomorrow in New York City. Our Managing Director, Benjamin Cox, will present...The markets continue to slump as the Oreninc Index fell for the fourth time in six weeks during the week ending April 25, 2013. The five- and three-week moving averages both fell to their lowest levels since last August. Total dollars announced was up from last week, but broker dollars announced fell significantly. The markets are not rebounding, and banks continue to struggle finding investors for early-stage exploration.

More than almost ever before, gold is being used for collateral for loans, hedge funds are borrowing to buy it, and Indians are using it for shadow banking loan reserves. There is a loan against a significant proportion of the world’s gold.

These are not 30-year fixed mortgages, these are not loans that as long as you pay the interest you get to keep the loans. These are collateralized loans. If you miss a payment, the gold will be sold, if the price of gold drops enough, the gold will be sold, if the rest of your portfolio has an issue, the gold can be sold.

The Oreninc Index fell to its lowest level since February for the week ending April 18, 2013. Total money announced fell to to its lowest level in 2013. Despite the overall drop in money announced, total brokered dollars announced remained almost flat. Unfortunately, here has been a 70% drop in total dollars announced when comparing Q1 2011 to Q1 2013. The equity market slump is continuing, with no clear sign of when a turnaround is likely to hit.

Before this ship can recover, we need to scrape some barnacles off the bottom, clean the oil tank of water, and buy some new spark plugs.

The barnacles are the junior exploration companies that cannot pay their rent, don’t have assets worth saving, and fail to understand that six months is not going to save them. Some of the projects we have looked at as an industry are not going to make it. Management should have the wisdom to say, “OK, what is an economically feasible project and what will it take for my project to make it to that stage?” If their project is NEVER going to make it, they should have the wisdom to kill it--and maybe even the company.