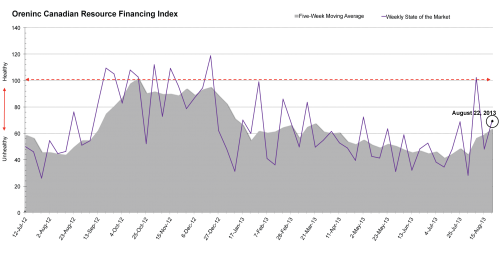

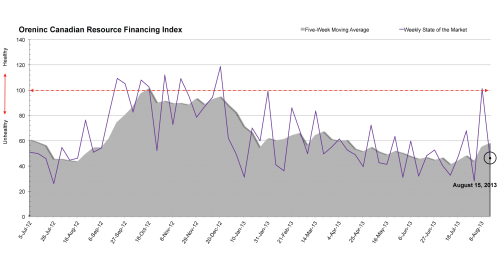

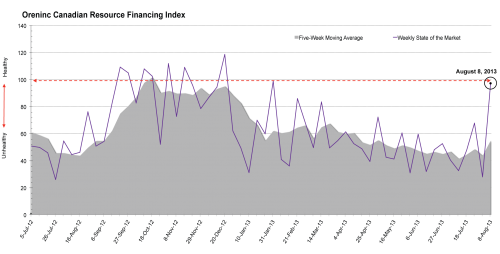

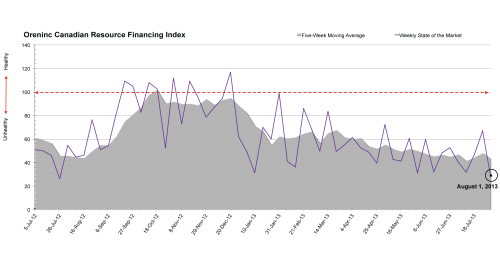

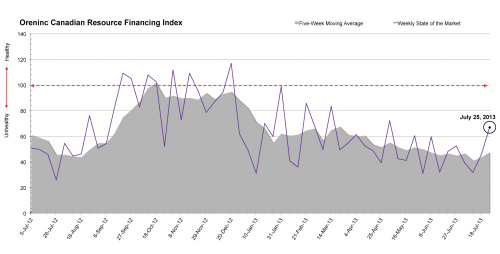

Index Five-Week Moving Average Climbs for Third Straight Week

The Oreninc Index five-week moving average reached a 22-week high, climbing for the third straight week and for the fifth time in six weeks. In addition, 45 offerings were announced last week, the most since February. It certainly appears the summer lull is coming to an end. The major remaining question: will the Fall and Winter markets come back with gusto or will 2013 end as it began?

We had a real estate bubble, driven by cheap money and easy lending, and we all know how it ended in the US. The solution to get us out of the...

We had a real estate bubble, driven by cheap money and easy lending, and we all know how it ended in the US. The solution to get us out of the...