ORENINC INDEX down as bought deals fall away

ORENINC INDEX - Monday, September 2nd 2019

North America’s leading junior mining finance data provider

Sign up for our free newsletter at www.oreninc.com

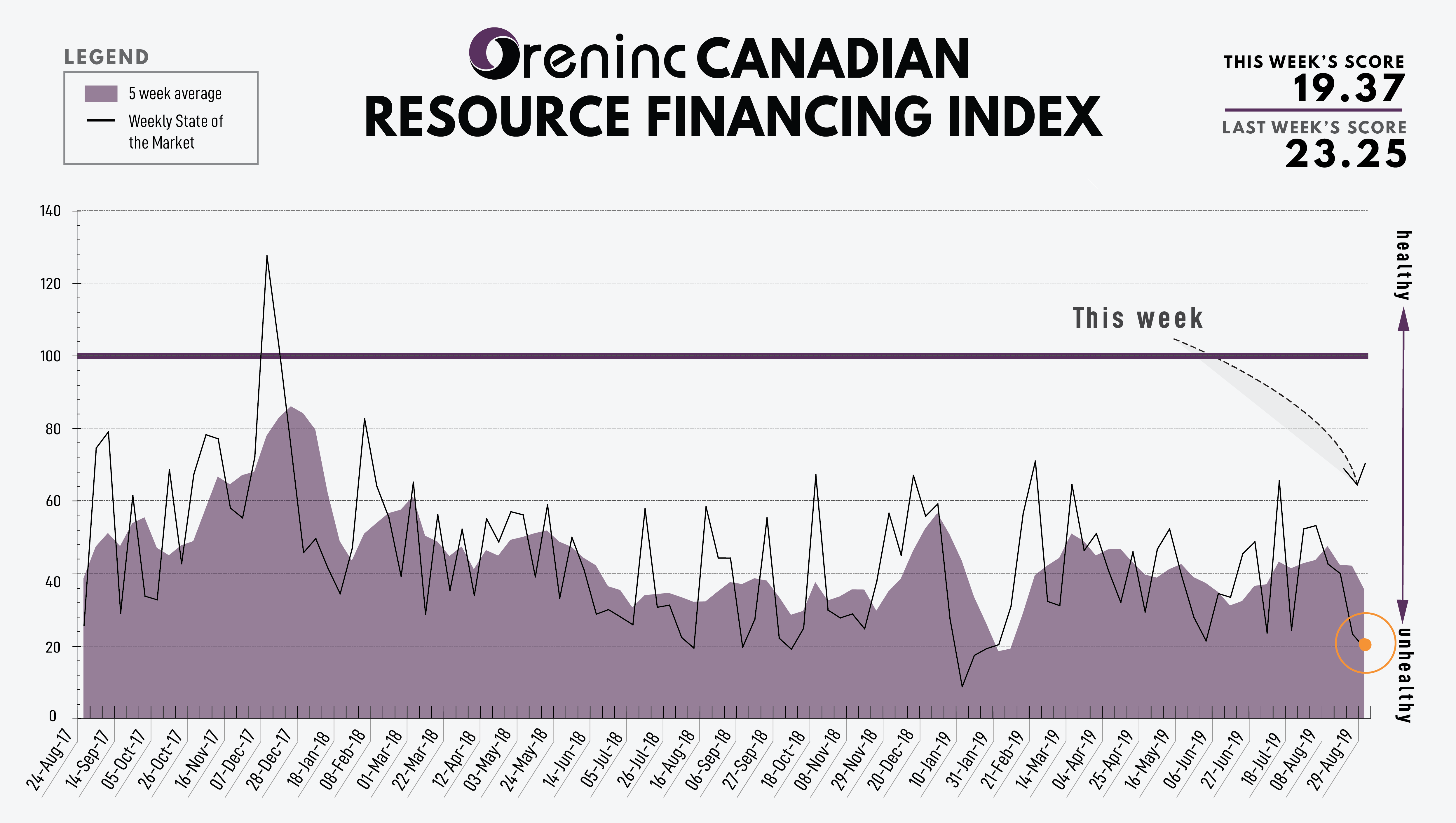

Last Week: 23.25

This week: 19.37

Silver Spruce Resources (TSXV:SSE) closed a financing and raised $261,250.

The Oreninc Index more fell in the week ending August 30th, 2019 to 19.37 from 23.25 as bought deals fell away as summer drew to a close with a major hurricane bearing down on the US as the country celebrated Labor Day weekend.

Trade war rhetoric continued to be exchanged between the US and China resulting in upward momentum in the gold price being clipped and a recovery in the DJIA as the US dollar index strengthened. The situation between the two nations remains tense as the US sent a warship through international waters near the Spratly Islands, over which China claims sovereignty.

Ah sovereignty! A very misunderstood word, especially in the UK where prime minister Boris Johnson appears dead set on the nation leaving the European Union at the end of October come hell or high water. It increasingly looks like the only way this can happen is without agreeing a deal, the so-called hard Brexit. To this end he has sought to prorogue the UK parliament—that is, suspend it for five weeks in September and October—to prevent resistance from fellow parliamentarians. With sterling continuing its downward trajectory, the weekend saw protests across the UK against this “coup” by Johnson. The polarisation of the public about whether or not to remain within the EU is now polarising Parliament across party lines on constitutional grounds.

This weekend also marked the 80th anniversary of the start of World War II with many European leaders gathering in Poland, where the first Nazi attack occurred. US president Donald Trump decided not to go, preferring to play gold instead. The many outcomes of the war included the creation of the United Nations and the European Union, both conceived to provide a means for nations to settle their disputes without resorting to the use of force.

Democracy continues to generate mass protests in Hong Kong, with police and protestors again facing off over the weekend.

On to the money: total fund raises fell to C$19.7 million, a 12-week low, which included no brokered financings and no bought-deal financings. The average offer size decreased to $1.1 million, a 13-week low, while the number of financings increased to 18.

Gold saw a mixed week peaking at US$1,542/oz before closing down at $1,520/oz from US$1,526/oz a week ago. The yellow metal is up 18.55% so far this year. The US dollar index showed strength as it closed up at 98.91 from 97.64 last week. The Van Eck managed GDXJ saw some profit taking as it closed down at US$41.05 from $$41.22 a week ago. The index is now up 35.84% so far in 2019. The US Global Go Gold ETF closed up at US$17.39 from US$16.95 a week ago. It is up 52.41% so far in 2019. The HUI Arca Gold BUGS Index closed up at 228.24 from 226.21 last week. The SPDR GLD ETF saw its inventory take a significant jump to 878.31 tonnes from 859.83 a week ago after hitting a mid-week high of 882.41 tonnes.

In other commodities, silver continued its recent tear by adding the best part of another dollar to close up at US$18.38/oz from $17.43/oz a week ago. Copper continues in the doldrums as it closed up at US$2.55/lb from $2.53/lb a week ago. Oil continues to suffer as well as WTI closed up at US$55.10 a barrel from $54.17 a barrel a week ago.

The Dow Jones Industrial Average saw a rebound as it closed up at 26,403 from 25,628 a week ago. Canada’s S&P/TSX Composite Index also closed up at 16,442 from 16,037 the previous week. The S&P/TSX Venture Composite Index closed up at 589.36 from 581.95 last week.

Summary

· Number of financings increased to 18.

· No brokered financings were announced this week, an eight-week low.

· No bought-deal financings were announced this week, an eight-week low.

· Total dollars down to $19.7m, a 12-week low.

· Average offer decreased to $1.1m, a 13-week high.

Major Financing Openings

· Commerce Resources (TSXV:CCE) opened a $3.0 million offering on a best efforts basis. Each unit includes a warrant that expires in a year.

· Prophecy Development (TSX:PCY) opened a $2.6 million offering on a best efforts basis.

· Generation Mining (CSE:GENM) opened a $2.02 million offering on a best efforts basis.

· Dolly Varden Silver (TSXV:DV) opened a $2.0 million offering on a strategic deal basis.

Major Financing Closings

· Amarillo Gold (TSXV:AGC) closed a $10.01 million offering underwritten by a syndicate led by Mackie Research Capital on a bought deal basis. Each unit included a warrant that expires in two years.

· Sandspring Resources (TSXV:SSP) closed a $7.5 million offering on a best efforts basis. Each unit included a warrant that expires in five years.

· Radisson mining Resources (TSXV:RDS) closed a $6.0 million offering underwritten by a syndicate led by Laurentian Bank Securities on a best efforts basis.

· K2 Gold (TSXV:KTO) closed a $3.5 million offering on a best efforts basis.

Company News

Silver Spruce Resources (TSXV:SSE) closed a financing and raised $261,250.

· 5.2 million units @ C$0.05.

· Each unit comprises one share and one warrant exercisable at $0.075 for two years.

· Proceeds will be used to conduct due diligence and exploration activities.