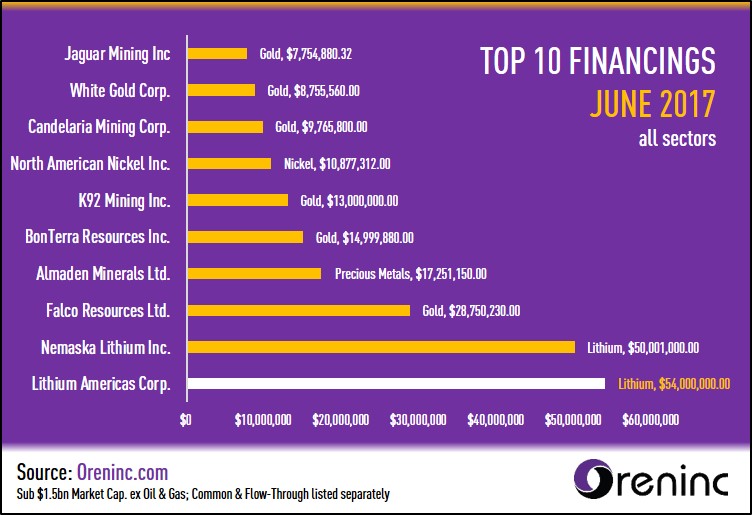

Top 10 Financings of June 2017

June 2017 saw 124 financings close in the Canadian financial markets for C$474.8 million. The top ten financings totalled $215.2 million with lithium taking the top two slots with two deals over $50 million. 19 brokered financings closed in June for $212.17 million at an average size of $11.2 million, including five bought deals for $105.2 million at an average size of $21.0 million.

In terms of gold, June saw 70 financings close totalling $164.7 million, some 34.7% of the total, with an average size of $1.7 million. This included 12 brokered financings for $91.5 million at an average size of $4.2 million, including three bought deals for $37.9 million at an average size of $12.6 million.

SIGN UP TO ORENINC.COM AND RECEIVE

FREE DAILY & WEEKLY FINANCING UPDATES!

#1 Lithium Americas $54.0 million

Lithium Americas (TSX: LAC) closed a US$40 million (C$54 million) financing as part of a US$172 million strategic financing with China’s Ganfeng Lithium to finance Lithium America’s share of developing the Cauchari-Olaroz project in Jujuy, Argentina. Ganfeng bought 63.75 million shares @ C$0.85 and also executed a credit agreement for a US$125 million together with an off-take agreement for the purchase and sale of lithium products. A financing agreement with Thailand’s Bangchak will complete Lithium America’s contribution towards project financing with Chile’s SQM funding the remaining 50% pf project development costs. Cauchari-Olaroz is due to be in production in 2019.

#2 Nemaska Lithium $50.0 million

Nemaska Lithium (TSX: NMX) closed a bought deal financing for aggregate gross proceeds of $50.0 million by selling 47.6 million shares @ $1.05 through a syndicate of underwriters comprised of National Bank Financial, Echelon Wealth Partners, Cormark Securities and Eight Capital, as co-lead underwriters, and CIBC World Markets, Canaccord Genuity, Industrial Alliance Securities and Laurentian Bank Securities. The proceeds are for ongoing development of the Whabouchi lithium mine, the Whabouchi spodumene concentrator and the Shawinigan hydrometallurgical plant in Quebec, Canada. Testwork of high-purity lithium hydroxide and carbonate with consumers is ongoing. Nemaska sent a second 3.5t shipment of lithium hydroxide to Johnson Matthey which confirmed that it meets its specifications.

#3 Falco Resources $28.8 million

Falco Resources (TSXV: FPC) closed a bought deal financing for $28.8 million through the sale of 22.3 million units @ $1.29 through a syndicate of underwriters co-led by BMO Capital Markets and Macquarie Capital Markets Canada, and including Desjardins Securities, Haywood Securities, Canaccord Genuity, National Bank Financial, Raymond James and Beacon Securities. The net proceeds will be used to advance the Horne 5 project in the Abitibi Greenstone Belt in Quebec, Canada, including a dewatering program, building acquisitions and relocation, land purchases, purchasing of hoisting system equipment and pre-construction surface installations.

SIGN UP TO ORENINC.COM AND RECEIVE

FREE DAILY & WEEKLY FINANCING UPDATES!

Comments