ORENINC INDEX - Monday, September 21st 2020

North America’s leading junior mining finance data provider

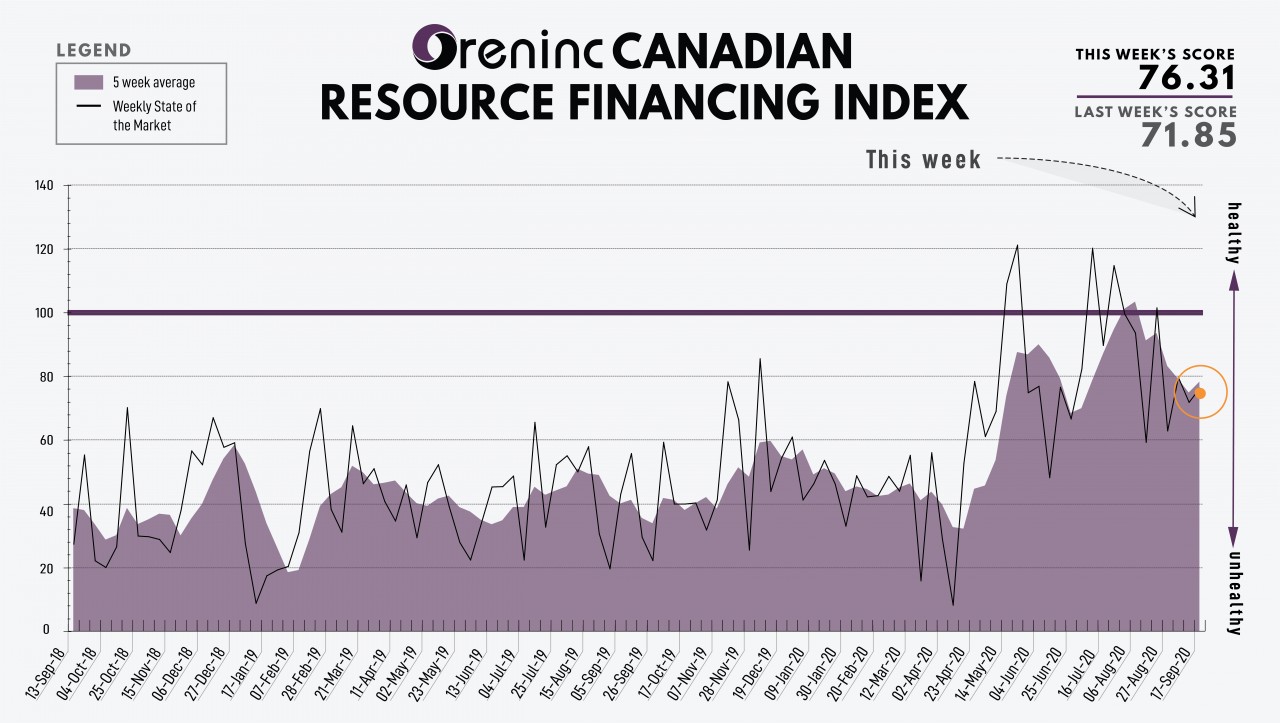

Last Week: 71.85 (Updated)

This week: 76.31

The Oreninc Index increased in the week ending September 18th, 2020 to 76.31 from an updated 71.85 a week ago as brokered activity increased.

The COVID-19 virus global death toll has topped 960,000 with almost 31 million cases reported worldwide, with many nations experiencing a resurgence of outbreaks.

We are in conference season! This past week saw the 2020 Precious Metals Summit, affectionately referred to Beaver Creek, which is arguably the most important investor event for the junior precious metals’ exploration and development space. The coming week will see the turn of the mid-tier and senior miners at the Gold Forum Americas. Both events are virtual this year, but that hasn’t stopped companies putting out a flurry of news releases.

Hedge fund giant Ray Dalio fired another shot over the bows of the greenback, stating that the dollar’s position as the global reserve currency is in jeopardy due to the trillions of dollars in fiscal spending and monetary injections the US has made to stave off the COVID-19 economic crisis.

The US Federal Reserve didn’t help matters after it indicated it would hold US interest rates at historic low levels until at least the end of 2023, putting doubt on the US recovery. General stocks fell as a result, even though there has been an improvement in unemployment data.

In the USA, initial weekly jobless claims fell 33,000 to 860,000 which was a lower fall than many were expecting. The four-week moving average for new claims fell to 912,000 from the prior week’s revised figure of 973,000, according to Labor Department data. Continuing jobless claims fell almost a million to 12.6 million while its four-week moving average fell to 13.5 million.

On a global level, OECD data showed the COVID-19 triggered economic slump may not be as pronounced as previously feared. It expects the world economy to shrink 4.5% this year, compared to a 6% decline prediction in June. China appears to be rebounding well with consumer spending rising for the first time this year and a larger-than-forecast expansion in industrial production.

The US will drop plans for a 10% tariff on certain types of Canadian aluminum which Canada reciprocated with an announcement that it would suspend plans to impose tariffs on C$3.6 billion of US aluminum products.

The environment for oil continues to be harsh as The International Energy Agency said the market has become more fragile, and cut its demand forecast for the fourth quarter by 600,000 barrels a day. OPEC earlier had cut its 2021 consumption outlook by 1.1 million barrels a day and oil trader Trafigura Group warned the oil market is about to go back into surplus.

On to the money: the aggregate financings announced increased to $151.4 million, a four-week high, which included seven brokered financings for $77 million, a four-week high, and three bought-deal financings for $67.5 million, a four-week high. The average offer size increased to $3.7 million, a four-week high, while the number of financings increased to 41.

A more stable week for Gold as the spot price closed up at $1,950/oz from $1,940/oz a week ago. The yellow metal is up 28.58 so far this year. The US dollar index weakened as it closed down at 92.92 from 93.33 a week ago. The VanEck managed GDXJ returned to growth as it closed up at $60.61 from $58.16 a week ago. The index is now up 43.42% so far this year. The US Global Go Gold ETF closed up at $24.01 from $23.57 a week ago. It is up 36.73% so far this year. The HUI Arca Gold BUGS Index also closed up at 342.84 from 341.38 last week. The SPDR GLD ETF inventory saw growth, closing the week up at 1,259.84 tonnes or 40.5 million ounces, from 1,248 tonnes last week.

In other commodities, Silver added a few cents as it closed the week up at $26,78/oz from $26.73/oz a week ago. Copper strengthened as it closed the week up at $3.11/lb from $3.03/lb a week ago. Oil strengthened as WTI closed up at $41.11 a barrel from $37.33 a barrel a week ago.

The Dow Jones Industrial Average closed down slightly at 27,657 from 27,665 a week ago. Canada’s S&P/TSX Composite Index closed down at 16,198 from 16,222 the previous week. The S&P/TSX Venture Composite Index closed up at 745.37 from 733.37 last week.

Summary

- Number of financings increased to 41.

- Seven brokered financings were announced this week for $77 million, a four-week high.

- Three bought-deal financings were announced this week for $67.5 million, a four-week high.

- Total dollars increased to $151.4 million, a four-week high.

- Average offer increased to $3.7 million, a four-week high.

Financing Highlights

Wallbridge Mining Company (TSX:WM) opened a bought deal financing to raise $56 million.

- 49 million shares @ $1.15.

- BMO Capital Markets as lead underwriter.

- Kirkland Lake Gold (TSX:KL) has participation rights and will participate to increase its post-closing ownership to about 9.9%.

- Proceeds will be used for continued advancement of the Fenelon gold project in Quebec, Canada.

Major Financing Openings

- Wallbridge Mining Company (TSX:WM) opened a $56 million offering underwritten by a syndicate led by BMO Capital Markets on a bought deal basis. The deal is expected to close on or about October 2nd.

- Desert Mountain Energy (TSXV:DME) opened a $13 million offering on a best efforts basis. Each unit includes a warrant that expires in two years. The deal is expected to close on or about October 15th.

- Kodiak Copper (TSXV:KDK) opened a $12.52 million offering on a best efforts basis. The deal is expected to close on or about October 6, 2020.

Major Financing Closings

- Integra Resources (CSE:ITR) closed a $31.28 million offering underwritten by a syndicate led by Raymond James on a bought deal basis.

- Aftermath Silver (TSXV:AAG) closed a $17.14 million offering on a best efforts basis.

- Monarch Gold (TSX:MQR) closed a $13 million offering underwritten by a syndicate led by Stifel GMP on a bought deal basis. Each unit included half a warrant that expires in two years.

Silver Dollar Resources (CSE:SLV) closed a $10.5 million offering on a best efforts basis.