ORENINC INDEX higher as financing appetite returns

ORENINC INDEX - Monday, January 24th 2022

North America’s leading junior mining finance data provider

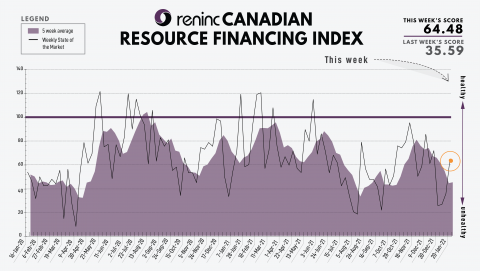

Last Week: 35.59 (Updated)

This week: 64.48

The Oreninc Index increased in the trading week ending January 21st, 2022 to 64.48 from 35.59 a week ago as the appetite for financings slowly but surely returns.

On to the money: the aggregate financings announced increased to $141 million, a 9-week high, with 5 new brokered financings and 5 new bought-deal financings announced. The average offer size increased to $6.1 million, a 22-week high, and the number of financings increased to 23.

Gold closed the week up at $1,831/oz from $1,816/oz a week ago. The US dollar index closed up at 95.64 from 95.17 a week ago.

The widely followed junior mining index, the VanEck managed GDXJ, closed the week up at $41.06 from $40.47 a week ago. HUI Arca Gold BUGS Index, which follows the major gold miners, closed the week higher at 262.51 from 261.62 last week. The SPDR GLD ETF inventory closed the week lower at 976.21 tonnes, or 31.38 million ounces, from 976.21 tonnes last week.

In other commodities, Slveir closed the week higher at $24.35/oz from $22.44/oz a week ago. Copper closed higher at $4.52/lb from $4.42/lb a week ago. Oil went higher as WTI closed higher at $85.14 a barrel from $83.82 a barrel a week ago.

The Dow Jones Industrial Average closed lower at 34,265 from 35,911 a week ago. Canada’s S&P/TSX Composite Index closed lower at 20,621 from 21,357 the previous week. The S&P/TSX Venture Composite Index closed lower at 856.62 from 902.99 a week ago.

Summary:

• Number of financings increased to 23.

• Five brokered financing were announced this week for $99m, a 10-week high.

• Five bought-deal financing were announced this week for $99m, a 44-week high.

• Total dollars increased to $141m, a 9-week high.

• Average offer upped to $6.1m, a 22-week high.

Major Financing Openings:

• Talon Metals Corp. (TSX:TLO) opened a $33.9 million offering underwritten by a syndicate led by TD Securities Inc. on a bought deal basis.

• Amex Exploration Inc. (TSX-V:AMX) opened a $33.74 million offering underwritten by a syndicate led by PI Financial Corp. on a bought deal basis. The deal is expected to close on or about February 15, 2022.

• Adventus Mining Corp. (TSX-V:ADZN) opened a $30 million offering underwritten by a syndicate led by Raymond James Ltd. on a bought deal basis. Each unit includes a 1/2 warrant that expires in 24 months. The deal is expected to close on or about January 26, 2022.

• Revival Gold Inc. (TSX-V:RVG) opened a $9.75 million offering on a best efforts basis. Each unit includes a 1/2 warrant that expires in 24 months. The deal is expected to close on or about January 25, 2022.

Major Financing Closings:

• Pasofino Gold Ltd. (TSX-V:VEIN) closed a $6.52 million offering on a best efforts basis.

• Western Uranium & Vanadium Corp. (CSE:WUC) closed a $4.59 million offering on a best efforts basis. Each unit includes 1 warrant that expires in 36 months.

• Canagold Resources Ltd. (TSX:CCM) closed a $2.31 million offering on a best efforts basis. The deal is expected to close on or about January 18, 2022.

• Midland Exploration Inc. (TSX-V:MD) closed a $2.06 million offering on a best efforts basis.

Comments