ORENINC INDEX falls though financings remain healthy – Jul 20, 2020

ORENINC INDEX - Monday, July 20th 2020

North America’s leading junior mining finance data provider

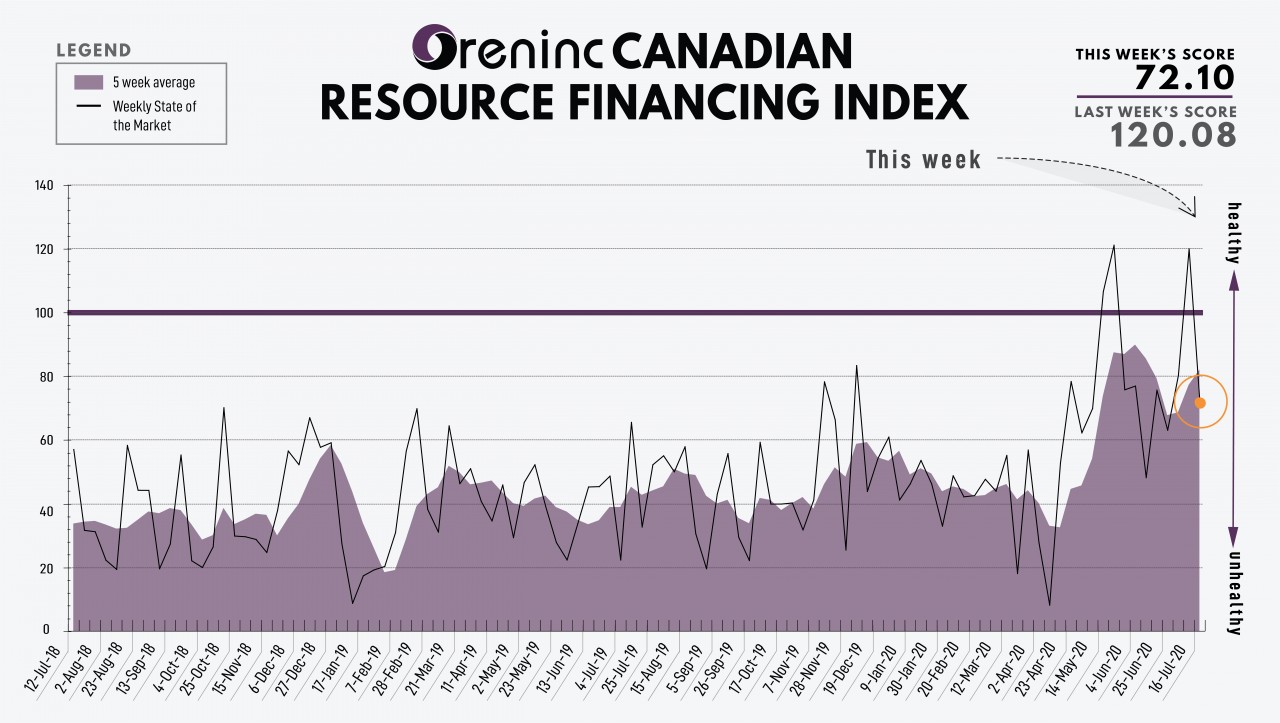

Last Week: 120.08 (Updated)

This week: 72.10

After an exceptional week last week, the Oreninc Index fell in the week ending July 17th, 2020 to 72.10 from an updated 120.08 a week ago though financings remain healthy.

The COVID-19 virus global death toll has reached 602,000 and 14.3 million cases reported worldwide.

The pressure is increasing in Washington to agree to another stimulus package as previous measures are set to expire in the coming weeks. The Trump administration wants another package, to be agreed before the summer recess in August, although not exceeding US$1 trillion. The European Union is also discussing more stimulus including €500 billion of EU-issued debt in grants and €250 billion in loans.

As feared, the spike in COVID-19 cases saw 1.3 million people file for first-time jobless claims in the USA, according to the Labor Department. The four-week moving average for new claims fell 60,000 to 1.375 million. Continuing jobless claims decreased 422,000 to a seasonally adjusted 17.338 million.

China’s economy grew 3.2% in the three months to June compared to the prior-year period, beating forecasts of 2.4%, although consumer spending was weaker than expected.

US-China tensions continue to run high as president Trump stripped Hong Kong of certain special privileges. The move created uncertainty for financial institutions in the financial hub. Doubling down, the Trump administration overtly rejected China’s expansive claims in the South China Sea, with Secretary of State Michael Pompeo saying they are "completely unlawful." For its part, China said it would impose sanctions on Lockheed Martin after the US approved a deal to supply missile parts to Taiwan.

On to the money: financings decreased by $100 million to $145 million, a two-week low, which included five brokered financings for $62.55 million, a two-week low, and two bought-deal financings for $55.05 million, a two-week high. The average offer size fell to $2.7 million, a three-week low, while the number of financings decreased to 53.

The Gold spot price consolidated above $1,800/oz and registered its five consecutive weeks of moving higher as it to closed up at $1,810/oz from $1,798/oz a week ago. The yellow metal is up 19.32% so far this year. The US dollar index continued its losing streak as it closed down at 95.94 from 96.65 last week. The VanEck managed GDXJ continues on a tear as it closed up at $54.83 from $53.03 a week ago. The index is now up 29.47% so far in 2020. The US Global Go Gold ETF also closed up at $22.90 from $22.28 a week ago. It is up 30.41% so far in 2020. The HUI Arca Gold BUGS Index closed up at 317.89 from 311.54 last week. The SPDR GLD ETF inventory continued to increase, closing the week up at 1,206.89 tonnes or 38.8 million ounces from 1,200.46 tonnes last week.

In other commodities, Silver continued on a tear as the spot price closed up at $19.33/of from $18.72/oz a week ago. Copper continued to rise as it closed up at $2.90/lb from $2.89/lb a week ago. Oil was flat as WTI closed up a tad at $40.59 a barrel from $40.55 a barrel a week ago.

The Dow Jones Industrial Average closed up at 26,671 from 26,075 a week ago. Canada’s S&P/TSX Composite Index closed up at 16,123 from 15,713 the previous week. The S&P/TSX Venture Composite Index fell to 974.95 from 684.71 last week.

Summary

- Number of financings decreased to 53.

- Five brokered financings were announced this week for $62.55 million, a two-week low.

- Two bought-deal financings were announced this week for $55.05 million, a two-week low.

- Total dollars decreased to $145 million, a two-week low.

- Average offer decreased to $2.7 million, a three-week low.

Financing Highlights

Caldas Gold (TSXV:CGC) announced a bought deal private placement to raise $45 million.

- 20 million special warrants @ $2.25.

- Each special warrant will entitle the holder to receive one unit of Caldas Gold with each unit comprising one share and one warrant exercisable @ $2.75 for five years.

- Scotiabank and Canaccord Genuity co-lead underwriters.

- Wheaton Precious Metals will subscribe for up to $5 million of the offering.

- Proceeds to be used for the expansion of the underground mining operations at the Marmato gold mine in Caldas, Colombia.

Major Financing Openings

- Caldas Gold (TSXV:CGC) opened a $45 million offering underwritten by a syndicate led by Scotiabank on a bought deal basis. Each unit includes a warrant that expires in five years. The deal is expected to close on or about July 29th.

- Silver Tiger Metals (TSXV:SLVR) opened a $11 million offering on a best efforts basis. Each unit includes a warrant that expires in three years.

- Aurcana Corporation (TSXV:AUN) opened a $10.5 million offering on a best efforts basis. Each unit includes a warrant that expires in three years.

- Northern Dynasty Minerals (TSX:NDM) opened a $10.18 million offering on a best efforts basis.

Major Financing Closings

- Mako Mining (TSXV:MKO) closed a $28.40 million offering underwritten by a syndicate led by Stifel GMP on a bought deal basis. Each unit included half a warrant that expires in 18 months.

- Osino Resources (TSXV:OSI) closed a $17.71 million offering underwritten by a syndicate led by Stifel GMP on a bought deal basis. Each unit included half a warrant that expires in a year.

- Thor Explorations (TSXV:THX) closed a $13.55 million offering underwritten by a syndicate led by H & P (Advisory) on a best efforts basis.

- Harte Gold (TSXV:HRT) closed a $12.9 million offering on a best efforts basis.

Positions

-

1 (685X328) px

Positions

-

1 (685X328) px

Popular Position

-

1 (443x328) px

Comments