ORENINC INDEX falls although brokered action continues

ORENINC INDEX - Monday, June 8th 2020

North America’s leading junior mining finance data provider

We, at Oreninc, believe black lives matter.

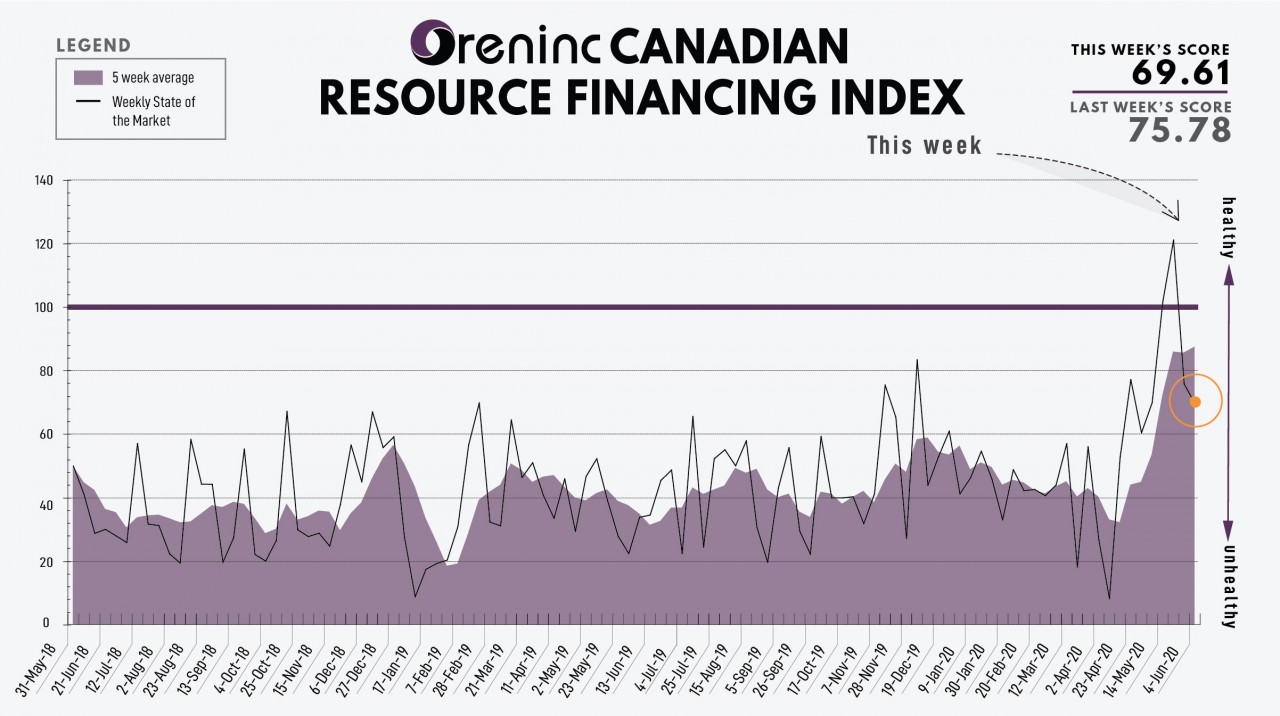

Last Week: 75.78 (Updated)

This week: 69.61

The Oreninc Index fell in the week ending June 5th, 2020 to 69.61 from an updated 75.78 a week ago although brokered deals are still in evidence.

The COVID-19 virus global death toll is nearing 400,000 and almost 7 million cases reported worldwide.

An unexpectedly positive US jobs report saw precious metals sell-off as the stock market leapt higher on a wave of sentiment about economic recovery following the contraction caused by COVID-19. The Bureau of Labor Statistics said 2.5 million jobs were created in May flipping expectations of up to 7.75 million job losses. The report also said the unemployment rate fell to 13.3%. Earlier, the agency reported another 1.88 million people filing for first-time jobless claims bringing the total since March 21st to 40.77 million. Industrial raw materials such as copper and oil both benefited from this.

This was certainly better news than that issued by the Congressional Budget Office (CBO) at the start of the week when it stated the COVID-19 impact will wipe out US$7.9 trillion as it reduces economic output by 3% through 2030.

This news, however, was thrust into the background by the daily mass protests in cities across the country against the death of George Floyd at the knee of a police officer in Minnesota and the increasingly hostile and militaristic stance president Donald Trump is taking against the basic freedoms his citizens are supposed to enjoy.

The events of the past ten days are eroding the soft power the US has enjoyed as a beacon for democracy as the Trump administration continues a tense exchange with China over trade, currency valuation and more recently the suppression of freedoms in Hong Kong. Trump has ceded the moral high ground allowing China to reflect that what is good for the goose is good for the gander.

In Europe, the European Central Bank increased its emergency spending program by €600 billion to a total of €1,350 billion.

On to the money: brokered action eased-off as the total raises announced fell again to $77.7 million, a seven-week low, which included four brokered financings for $23.75 million, a four-week low, and no bought deal financings. The average offer size fell to $1.46 million, a seven-week low, although the number of financings increased to 53.

Gold sold-off sharply as the week drew to a close following the US jobs report as the spot price closed down at $1,685/oz from $1,730/oz a week ago. The yellow metal is up 11.06% so far this year. The US dollar index fell again to 96.93 from 98.34 last week. The VanEck managed GDXJ saw its trajectory continue downwards as it closed down at $44.38 from $46.08 a week ago. The index is now up 5.02% so far in 2020. The US Global Go Gold ETF also closed down at $18.59 from $19.81 a week ago. It is up 5.87% so far in 2020. The HUI Arca Gold BUGS Index closed down at 261.26 from 273.33 last week. The SPDR GLD ETF inventory continued to increase, cresting at 1,133.37 tonnes before closing the week slightly down at 1,128.11 tonnes from 1,128.4 tonnes last week.

In other commodities, silver surged up to $18.30/oz before falling to close down at $17.41/oz from $17.87/oz a week ago. Copper reached its highest level since early March as it closed up at $2.55/lb from $2.42/lb a week ago. Oil continued its recovery as WTI closed up at $39.55 a barrel from $35.49 a barrel a week ago.

The Dow Jones Industrial Average roared onwards as it closed up at 27,110 from 25,383 a week ago. Canada’s S&P/TSX Composite Index closed up at 15,854 from 15,192 the previous week. The S&P/TSX Venture Composite Index closed up at 556.91 from 553.77 last week.

Summary

- Number of financings increased to 53.

- Four brokered financings were announced this week for $23.75 million, a four-week low.

- No bought-deal financings were announced this week.

- Total dollars decreased to $77.7 million, a seven-week low.

- Average offer lessened to $1.46 million, a seven-week low.

Financing Highlights

Galway Metals (TSXV:GWM) opened a best efforts private placement to raise $12.25 million which was upsized to $17.35 million.

- Syndicate of agents lead by Paradigm Capital and including Laurentian Bank Securities.

- 17.9 million charity flow-through shares @ $0.635 and up to 13.6 million hard-dollar shares @ $0.44 from an original 11.4 million charity flow-through shares and up to 11.4 million hard-dollar shares.

- Eric Sprott agreed to purchase $3 million hard dollar shares which will bring his fully diluted ownership interest to 4%.

- Proceeds to fund ongoing exploration.

Major Financing Openings

- Galway Metals (TSXV:GWM) opened a $12.25 million offering underwritten by a syndicate led by Paradigm Capital on a best efforts basis.

- Luminex Resources (TSXV:LR) opened a $10 million offering underwritten by a syndicate led by Haywood Securities on a best efforts basis. The deal is expected to close on or about June 24th.

- Lions Bay Mining (TSX:LBM) opened a $6 million offering on a best efforts basis. Each unit includes half a warrant that expires in two years.

- Outcrop Gold (TSXV:OCG) opened a $5 million offering underwritten by a syndicate led by Mackie Research Capital on a best efforts basis. Each unit includes half a warrant that expires in two years. The deal is expected to close on or about June 12th.

Major Financing Closings

- Spartan Delta (TSXV:RTN) closed a $64 million offering on a best efforts basis.

- Sabina Gold & Silver (TSX:SBB) closed a $54.59 million offering underwritten by a syndicate led by BMO Capital Markets on a bought deal basis.

- Great Bear Resources (TSXV:GBR) closed a $33 million offering underwritten by a syndicate led by Canaccord Genuity on a bought deal basis.

- New Placer Dome Gold (TSXV:NGLD) closed a $12.35 million offering on a best efforts basis.