ORENINC INDEX up as substantial financings fell away

ORENINC INDEX - Monday, April 6th 2020

North America’s leading junior mining finance data provider

Subscribe to our weekly updates at oreninc.com/subscribe

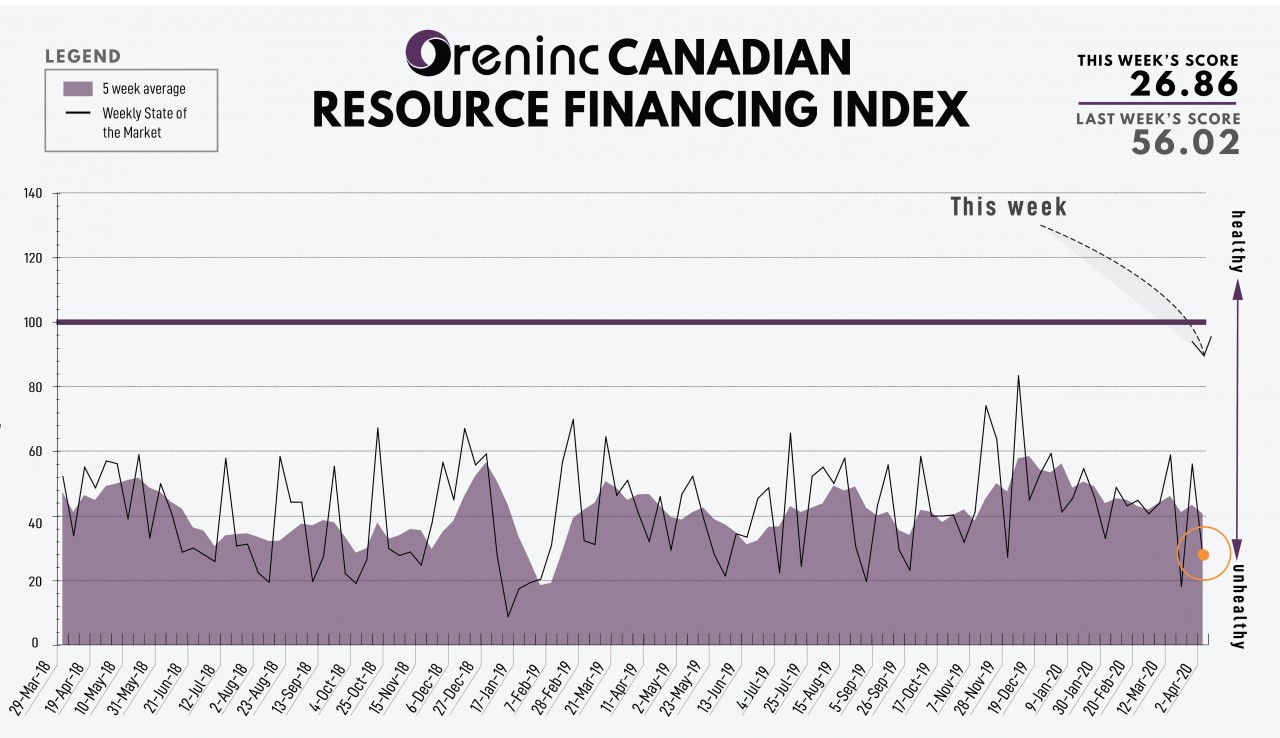

Last Week: 56.02 (Updated)

This week: 26.86

The Oreninc Index fell in the week ending March April 3rd, 2020 to 26.86 from an updated 56.02 as substantial financings fell away.

In many ways, the past seven days was a calmer week for the markets although the death toll, number of infections, and economic woes from the COVID-19 virus outbreak mounted up. France and the UK saw significant increases in their daily death tolls while Italy finally saw some stabilization.

Almost one and a quarter million people have now been infected by the virus, with over 60,000 deaths so far and almost a quarter of a million people have recovered. Europe and the USA are the joint epicentres of the virus outbreak with US President Donald Trump warning that the next two weeks are going to be “very, very painful”. White House projections put the potential death toll at 100,000 to 240,000 lives.

With the federal government reluctant to impose a nationwide quarantine and step on states’ rights the majority of the states of the republic have done so, although domestic flights are still numerous. President Trump extended federal coronavirus guidelines such as social distancing until at least 30th April.

With various industrial sectors in the US asking for billion-dollar bailouts, the impacts of the slowdown in activity are rippling through the world’s largest economy. The US Bureau of Labour Statistics reported the US economy lost 701,000 jobs in March, much worse than forecasters expected, with the unemployment increasing to 4.4% from 3.5% in February. Earlier, the government reported a 6.6 million increase in jobless claims, double the 3 million forecast.

The end of the first quarter saw the Dow record its biggest quarterly decline since 1987.

Energy markets had a dramatic week, with the benchmark WTI falling to around US$20 a barrel before later jumping 40% after President Trump tweeted Russia and Saudi Arabia would reduce output, and then on news that China was thinking of stocking a strategic reserve.

On to the money: total fund raises more than halved to $37 million, a two-week low, which included two brokered financings for $2.5 million, a two-week low, and no bought-deal financings. The average offer size fell by two-thirds to $1.76 million, a two-week low, while the number of financings increased to 21.

Gold had a less volatile week with the spot gold price closing down at US$1,620/oz from $1,628/oz a week ago. The yellow metal is up 6.82% so far this year. The US dollar index increased again to close up at 100.67 from 98.32 last week. The VanEck managed GDXJ lost more ground as it closed down at $29.71 from $29.91 a week ago. The index is down 29.7% so far in 2020. The US Global Go Gold ETF continued to regain ground as it closed up at $13.00 from $12.73 a week ago. It is down 25.97% so far in 2020. The HUI Arca Gold BUGS Index closed up as well at 200.41 from 194.21 last week. The SPDR GLD ETF inventory continued to increase as it closed up at 978.99 tonnes from 964.66 tonnes a week ago, its highest level since January 2019.

In other commodities, spot silver also shed a few cents as it closed down at $14.38/oz from $14.47/oz a week ago. Copper continued flat as it closed up a cent at $2.17/lb from $2.16/lb a week ago. The oil price fell to $19.27 a barrel before WTI closed up at $29.00 a barrel from $21.84 a week ago.

The Chicago Board Options Exchange Volatility Index (VIX or fear index) continued to fall, closing down at 46.80 from 65.54 a week ago.

The Dow Jones Industrial Average had a less volatile week as it closed down at 21,052 from 21,636 a week ago. Canada’s S&P/TSX Composite Index rebounded however, to close up at 12,938 from 12,687 the previous week. The S&P/TSX Venture Composite Index closed down at 383.94 from 388.58 last week.

Summary

- Number of financings increased to 21.

- Two brokered financings were announced this week for $2.5 million, a two-week low.

- No bought-deal financings were announced this week.

- Total dollars fell to $37 million, a two-week low.

- Average offer decreased to $1.76 million, a two-week low.

Financing Highlights

Seabridge Gold (TSX:SEA) secured a $14.1 million non-brokered private placement from an existing shareholder.

- 1.2 million shares @ $11.75.

- The financing is expected to close April 16th.

- Proceeds to be used to cover potential tax liabilities stemming from re-assessments of the company’s Canadian exploration expenses by Canada Revenue Agency (CRA) and the possible requirement that Seabridge will have to reimburse investors who purchased flow-through shares which are subject to re-assessment.

Major Financing Openings

- Seabridge Gold (TSX:SEA) opened a $14.1 million offering on a best efforts basis. The deal is expected to close on or about April 16th.

- Skeena Resources (TSXV:SKE) opened a $10 million offering on a best efforts basis.

- Gold X Mining (TSXV:GLDX) opened a $2.5 million offering on a best efforts basis. Each unit includes a warrant that expires in three years.

- Canada Nickel Company (TSXV:CNC) opened a $2 million offering underwritten by a syndicate led by PI Financial on a best efforts basis. The deal is expected to close on or about April 22nd.

Major Financing Closings

- Almaden Minerals (TSX:AMM) closed a $2.04 million offering on a best efforts basis. Each unit included a warrant that expires in three years.

- Reunion Gold (TSXV:RGD) closed a $1.74 million offering on a best efforts basis. Each unit included half a warrant that expires in three years.

- Colorado Resources (TSXV:CXO) closed a $1.6 million offering on a best efforts basis. Each unit included half a warrant that expires in three years.

- Revival Gold (TSXV:RVG) closed a $1 million offering on a best efforts basis.