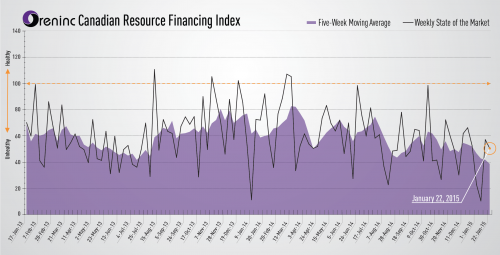

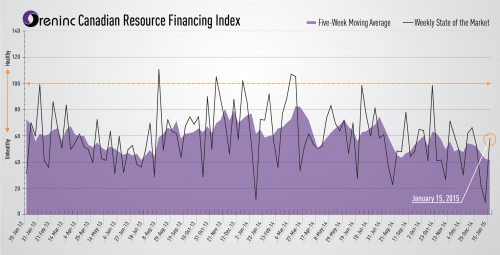

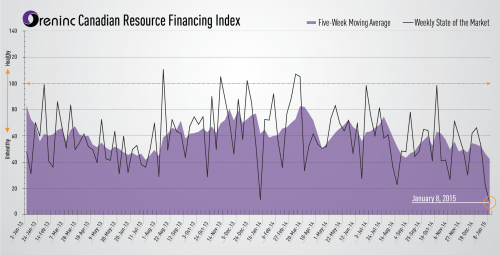

Oreninc Index Falls, Stays Respectable

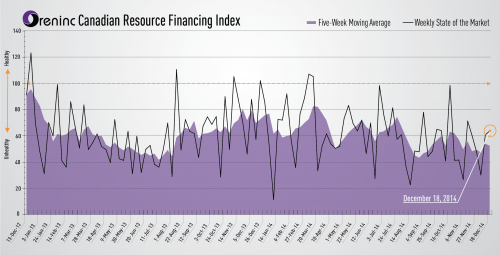

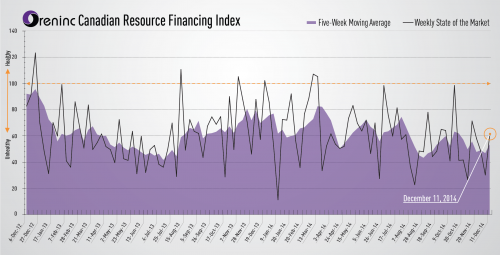

The Oreninc Index fell slightly for the week ending January 22, 2015. Total dollars announced dropped to $76m, a two-week low. Two brokered and bought financings were announced for $70m, both two-week lows.

Deals slowed a bit, with Goldcorp’s (TSX:G) purchase of Probe Mines Ltd. (TSX-V:PRB) and their Ontario Borden Gold project leading the charge. The all-stock deal is worth CDN$526m. Gold prices for the week were strong, ending above $1,300 an ounce for the first time since August. Oil prices increased briefly on Thursday with news of the death of Saudi Arabian King Abdullah, though they will probably come back down with the expectation that his successor will not change the country’s crude production policy.

Though sagging and not where they need to be, it’s nice to see two alright weeks strung together after two of the worst weeks in years.