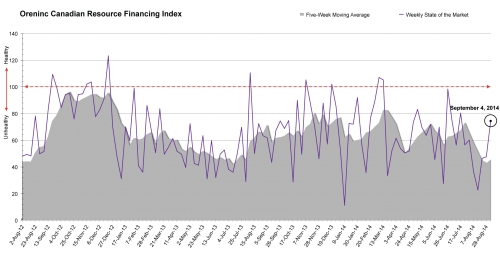

Oreninc Index Update: September 4, 2014

Oreninc Index Climbs to Highest Level Since July

The Oreninc Index rose to its highest levels since July for the holiday-shortened week ending September 4, 2014. Numbers were up across the board, with the most impressive number coming with average deal size, which had a YTD-high of $9.5m. Total dollars announced jumped to $199m, a seven-week high. Three brokered deals were announced for $80.1m, a seven-week high; one bought deal was announced for $60.1m, a ten-week high. This week was not carried by just one deal -- the strength of deals across the line was up, which is fairly impressive in light of previous weeks’ performances.

Despite the strong financing numbers, this week marked another light dealmaking week, with Integra Gold Corp’s (CVE:ICG) purchase of the bankrupt Sigma-Lamaque property -- adjacent to its Lamaque project in Val-d’Or, Quebec with a milling plant included -- maybe the biggest of the week. Canadian major Goldcorp (TSE: G) announced that they would likely hit the bottom end of this year’s output forecast range due to the stoppage of operations at two of its mines this year. Although deals were light, this week’s activity was something of a breath of fresh air after the feeling of being underwater for the past month and a half.

Summary:

- Deals announced dropped to 21, a three-week low.

- Three brokered deals were announced for $80.1m, a seven-week high.

- One bought deal was announced for $60.1m, a ten-week high.

- Total dollars exploded to $199m, a seven-week high.

- Average deal size rose to $9.5m, a YTD-high.

Major Financing Openings:

- Pine Cliff Energy Ltd. (TSX-V:PNE) opened a $60.07 million offering underwritten by a syndicate led by FirstEnergy Capital Corp. on a bought deal basis. The deal is expected to close on or about September 23, 2014.

- Petra Petroleum Inc. (TSX-V:PTL) opened a $54.5 million offering on a best efforts basis.

- Monument Mining Limited (TSX-V:MMY) opened a $25 million offering on a best efforts basis. The deal is expected to close on or about November 20, 2014.

- Tamarack Valley Energy Ltd. (TSX-V:TVE) opened a $10.05 million offering underwritten by a syndicate led by Dundee Securities Ltd. on a best efforts basis. The deal is expected to close on or about September 26, 2014.

Major Financing Closings:

- Tintina Resources Inc. (TSX-V:TAU) closed a $24 million offering on a strategic deal basis. Each unit includes 1 warrant that expires in 24 months.

- GB Minerals Ltd. (TSX-V:GBL) closed a $10.23 million offering on a best efforts basis.

- Rathdowney Resources Ltd. (TSX-V:RTH) closed a $8.61 million offering on a best efforts basis.

- NioGold Mining (TSX-V:NOX) closed a $4.9 million offering on a strategic deal basis.

Comments