Oreninc Index Update: September 11, 2017

ORENINC INDEX falls though financings strong

ORENINC INDEX - Monday, September 11th, 2017

North America’s leading junior mining finance data provider

Follow us on facebook and find us on Twitter @Oreninc

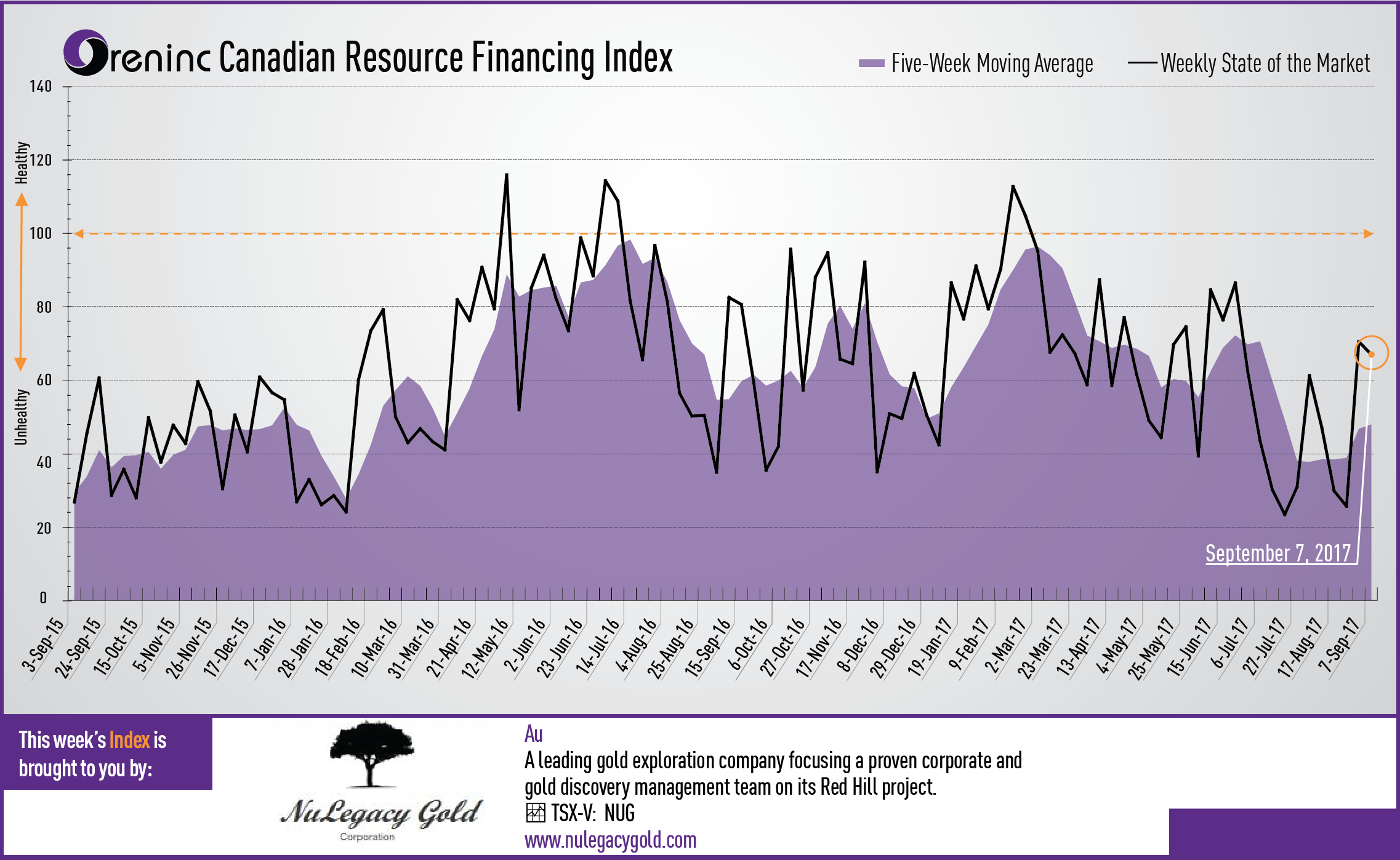

Last week index score: 70.51

This week: 67.02

NuLegacy Gold (TSXV: NUG) reported assays from reverse circulation holes drilled in the North Iceberg and newly discovered Serena zone of its Red Hill property in Nevada, USA.

LiCo Energy Metals (TSXV: LIC) entered into a property purchase with Glencore.

Castle Silver Resources (TSXV: CSR) signed a memorandum of understanding with Granada Gold Mine for the consideration of the processing of mineralised material from the Granada mine.

The Oreninc Index fell in the week ending September 7th, 2017 to 67.02 from 70.51 the previous week although there was strong bought deal activity, as the Labor Day holiday distorted the index.

Total fund raises announced increased to C$151.3 million, a ten-week high, which included five brokered financings for C$47.2 million, a two-week low, and four bought-deal financings for C$40.0 million, also a two-week low. The average offer size grew to C$6.1 million, a 27-week high, whilst the total number of financings announced decreased to 25, a two-week low.

The growth in metals prices of late ran out of steam at the end of the week as investors took profits, suggesting that prices may have gotten ahead of themselves.

The news focuses this week was on natural disasters with Hurricane Irma slamming into Florida as I write and as Hurricane Katia hits Mexico, following hot on the heels of Hurricane Harvey that recently hit Houston, Texas, and preceding Hurricane Jose that so far is following a similar course as Irma. At least 90 have also been killed by an 8.1 magnitude earthquake of the century just off Mexico’s southern coast. Many see such things as a sign of things to come as global warming effects change on weather patterns and increases the ferocity, damage potential and frequency of hurricanes. Such events should have profound implications for the rebuilding of coastal communities and where and in what form development can occur, but will public policy be up to the task?

Gold continued its climb to strength although it saw some profit-taking as the week ended, closing at US$1,346/oz up from US$1,325 last week. Gold is now up 17.4% since the start of the year. The van Eck managed GDXJ was lifted by the gold price increase and is now up 17.2% so far in 2017 to close the week at US$36.96. The recently launched US Global Go Gold ETF also had a strong week to close at US$13.74 from US$13.48 last week. The SPDR GLD ETF saw increased to raise inventories to 840 tonnes before profit-taking saw it close at 834 tonnes compared to 831 tonnes the previous week.

In other commodities, having recently broken through the US$17/oz mark silver raced on through the US$18/oz level before retreating slightly to close at US$17.97. Having experienced steady growth in recent weeks the red metal saw a sharp sell off on Friday to close at US$3.02/lb from US$3.12/lb the previous week. Oil also saw a sharp sell off on Friday, although still slightly up on the week, closing at US$47.48 per barrel, from US$47.29 per barrel last week.

After starting the week on a downward trajectory, the Dow Jones Industrial Average closed down at 21,797 from 21,987 last week. Canada’s S&P/TSX Composite Index downward bent was straight as an arrow as it closed down at 14,985 from 15,191 the previous week. The S&P/TSX Venture Composite Index also fell to close at 772.02 from 778.45 the previous week.

The Oreninc team recorded the latest in its series of podcasts this week with Mercenary Geologist, Micky Fulp. The recording will be posted to Oreninc.com shortly.

Summary:

- Number of financings fell to 25, a two-week low.

- Five brokered financings were announced this week for C$47.2m, a two-week low.

- Four bought-deal financings were announced this week for C$40.0m, a two-week low.

- Total dollars increased to C$151.3m, a ten-week high.

- Average offer size rose to C$6.1m, a 27-week high.

Financial news highlights

Novo Resources (TSXV: NVO) undertakes non-brokered equity private placement with Kirkland Lake Gold.

- Gross proceeds of C$56.0 million through the issuance of 14.0 million units @ C$4.0. Each unit consists of one share and one warrant exercisable @ C$6.0 for three years.

- Kirkland Lakw retains an anti-dilution right and can appoint one director.

- The net proceeds will be used to develop and explore Novo’s projects in the Pilbara region of Western Australia.

Major Financing Openings:

- Novo Resources (TSXV: NVO) opened a C$56 million offering on a strategic deal basis. Each unit includes a warrant that expires in 36 months. The deal is expected to close on or about September 15th.

- Barkerville Gold Mines (TSXV: BGM) opened a C$28 million offering underwritten by a syndicate led by Canaccord Genuity on a bought deal basis. The deal is expected to close on or about September 28th.

- Aurion Resources (TSXV: AU) opened a C$15.9 million offering on a best efforts basis. The deal is expected to close on or about September 13th.

- SDX Energy (TSXV: SDX) opened a C$12.21 million offering on a best efforts basis.

Major Financing Closings:

- Novo Resources (TSXV: NVO) closed a C$ 56 million offering on a strategic deal basis. Each unit included a warrant that expires in 36 months.

- SDX Energy (TSXV: SDX) closed a C$12.21 million offering on a best efforts basis.

- 88 Capital (TSXV: EEC) closed a C$5.25 million offering underwritten by a syndicate led by First Republic Capital on a best efforts basis. Each unit included half a warrant that expires in 36 months.

- Benz Mining (TSXV: BZ) closed a C$2.5 million offering on a best efforts basis

Company news

NuLegacy Gold (TSXV: NUG) reported assays from reverse circulation holes drilled in the North Iceberg and newly discovered Serena zone of its Red Hill property in Nevada, USA.

- A 100m step-out hole from the North Iceberg zone towards the Serena zone returned 21.3m @ 2.85g/t Au.

- Follow-up holes in the Serena zone discovery were drilled to confirm the new zone.

Analysis

As the company’s understanding of the geology of the area it is encountering more higher-grade areas that are associated with Carlin-type gold deposits. Drilling at Serena, in addition to confirming the discovery, also suggests possible convergence with the North Iceberg deposit.

LiCo Energy Metals (TSXV: LIC) entered into a property purchase with Glencore.

- To acquire mining rights patent #585 in Bucke Township, 6km east-northeast of Cobalt, Ontario, Canada.

- The property consists of 16.2 hectares that sits along the west boundary of LiCo’s Teledyne Cobalt project and covers the southern extension of the former producing 15 Vein on the past-producing Agaunico mine.

- In the early 1980s, 36 surface diamond drill holes totaling 3,323m were drilled that outlined two separate vein systems hosting cobalt and silver values.

Analysis

The property is adjacent to the company’s Teledyne cobalt property, which therefore increases the land available for exploration. The acquisition also gives the company access to the exploration data previously generated on the Glencore property that will assist the effort to discover and define new mineralisation. Should economic deposits be discovered, the agreement also outlines the potential for an offtake agreement with Glencore that would dramatically assist in its commercialisation.

Castle Silver Resources (TSXV: CSR) signed a memorandum of understanding with Granada Gold Mine for the consideration of the processing of mineralised material from the Granada mine.

- Castle is undertaking a study to install a 600 tonne per day gravity flotation plant.

- Potential synergies exist for processing Granada material while also Castle’s objectives in the Cobalt camp.

- Castle and Granada share common directors and qualified persons.

Comments