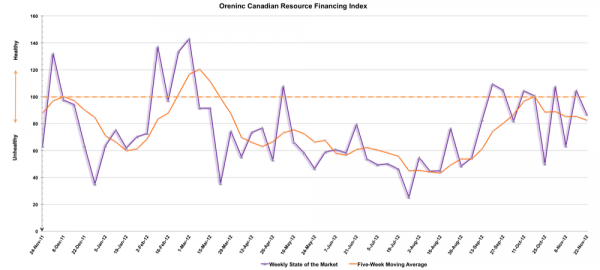

Oreninc Index Reverses Course for Fourth Straight Week

The Oreninc Index has once again changed directions and finished lower for the week ending November 22, 2012. This week was characterized by a large number of offerings under $1 million. During this time of the financing season, we tend to see offerings made out of desperation. Many junior companies need money now so that they can survive through the New Year while hoping that markets become stronger before exploration season begins in the spring.

Summary:

- Total number of opened deals increased to 47, a three-week high.

- 16 brokered deals were announced, an eight-week high; brokered dollars announced fell to $94 million.

- Five bought deals were announced, a five-week high.

- Total dollars announced was down significantly to $187 million.

- Average deal size dropped to $3.9 million.

Major Financing Openings:

- Elemental Minerals Ltd. (TSX:ELM) opened a $14.47 million private placement underwritten by a syndicate led by BMO Capital Markets on a best efforts basis.

- NuVista Energy Ltd. (TSX:NVA) opened a $64 million private placement on a best efforts basis. In addition, Nuvista also announced a $30.79 million private placement underwritten by a syndicate led by Peters & Co. on a bought deal basis. The deals are expected to close on or about December 11, 2012.

- Cub Energy Inc (TSX-V:KUB) opened a $15 million private placement underwritten by a syndicate led by GMP Securities on a best efforts basis.

- CB Gold Inc. (TSX-V:CBJ) opened a $10.01 million private placement underwritten by a syndicate led by BMO Capital on a bought deal basis. The deal is expected to close on or about December 10, 2012.

Major Financing Closings:

- Aureus Mining Inc. (TSX:AUE) closed an $80.28 million private placement underwritten by a syndicate led by GMP Securities LP on a best efforts basis. Each unit includes a 1/2 warrant that expires in 18 months.

- Seabridge Gold Inc. (TSX:SEA) closed a $24 million private placement underwritten by a syndicate led by Stonecap Securities on a bought deal basis.

- Klondex Mines Ltd. (TSX:KDX) closed a $22.93 million private placement underwritten by a syndicate led by GMP Securities on a best efforts basis. Each unit includes a 1/2 warrant that expires in 24 months.

- 3MV Energy (TSX-V:TMV) closed a $5 million private placement on a best efforts basis.