ORENINC INDEX marginally down as gold strengthens

ORENINC INDEX - Monday, March 27, 2017

North America’s leading junior mining finance data provider

Follow us on facebook and find us on Twitter @Oreninc

Kootenay Silver Inc. (TSXV: KTN) JV partner Antofagasta approves 3,000m drilling budget for five targets on the Silver Fox property.

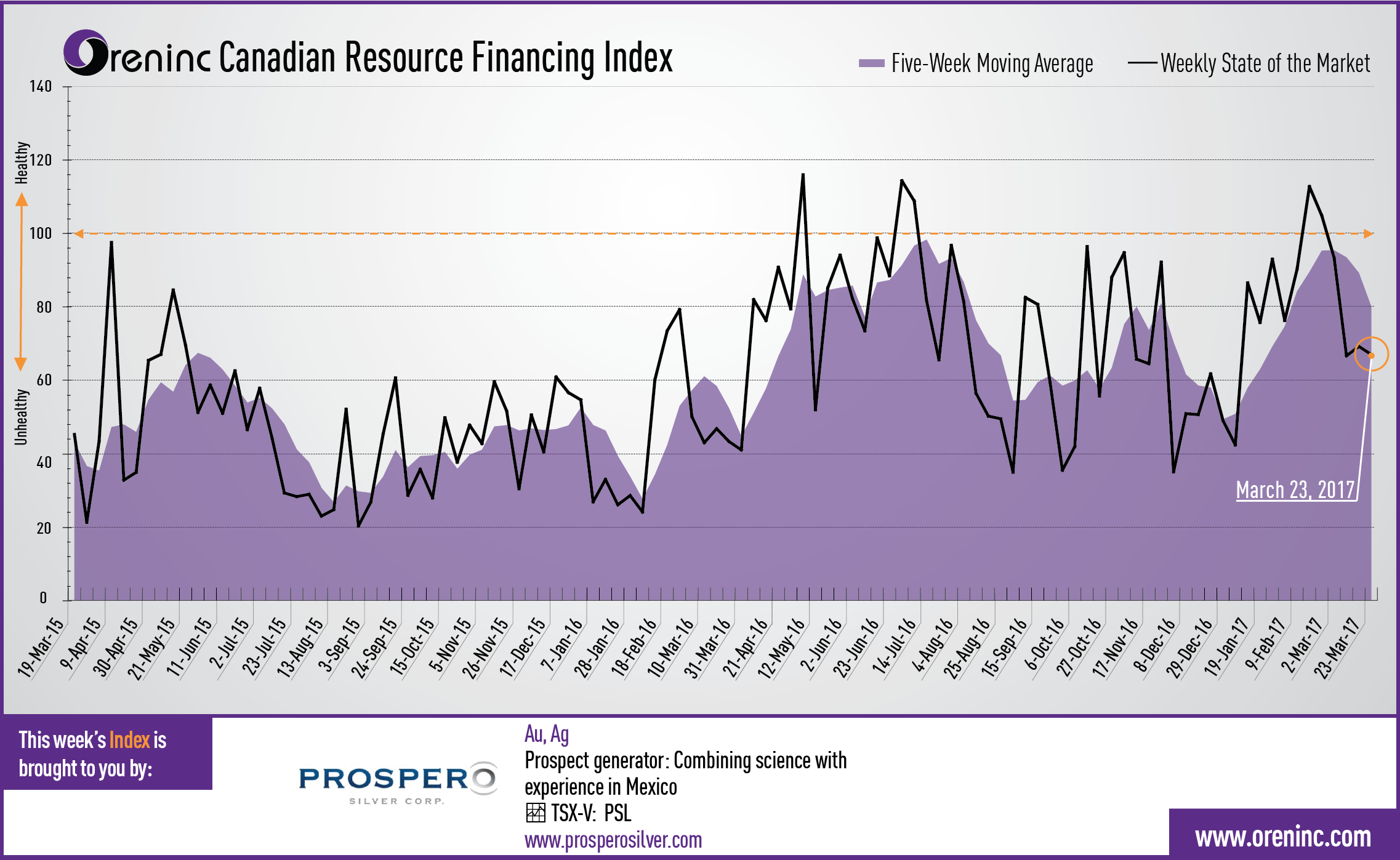

Last week index score: 69.20

This week: 67.02

The Oreninc Index fell in the week ending March 23, 2017 to 67.02 following the previous week’s 69.20 as gold continues to strengthen the US$1,200 per ounce level to close the week at US$1,242.

Whilst gold continued to slowly strengthen, copper came off 2.4% during the week to close at US$2.63 a pound, as supply concerns eased as production resumed at the Grasberg mine in Indonesia and the strike at the Escondida mine in Chile ended.

President Trump ran into a wall of opposition, including within the Republican party, regarding his attempt to repeal the Obamacare healthcare law, before finally abandoning the vote.

The number of financings increased to 32, a two-week high, although the total dollars fell to C$117.1m, a two-week low, whilst the average offer size fell to C$3.7m, also a two-week low. Of the 32 financings announced, there were five brokered financings for C$75.0m and no bought-deal financings. The week saw several sub C$1 million financings announced.

Although gold had another strong week, the industry’s leading benchmark index, the van Eck GDXJ fell slightly and is now up 14.74% so far in 2017, as did the inventory of the SPDR GLD ETF which fell to 832.6 tonnes this week. Whilst gold is rising it is not filtering through to lift other gold assets such as gold stocks of the ETFs.

WTI crude remains under US$50 and fell 2.35% to US$48 per barrel.

With a key Trump legislative initiative defeated the Dow Jones Industrial Average took a sharp fall downwards towards the end of the week to close at 20,596. In Canada, the S&P/TSX Composite Index also fell on the week to close at 15,442. In the junior space, the S&P/TSX Venture Composite Index fell to close the week at 803.60.

Financial news highlights

Coro Mining (TSX: COP) announced a non-brokered private placement financing of up to 107.7M shares @ C$0.15 to raise up to C$16.2M to fund the acquisition of Minera Rayrock and to continue to explore the Marimaca project. The Rayrock acquisition will provide Coro with the Ivan SX-EW plant located 18km from Marimaca that has capacity to produce 12,000 tpy of copper cathode. Coro announced a maiden mineral resource estimate in January of 145,500t of copper in the measured & indicated categories and 99,300t in the inferred category.

BonTerra Resources (TSX-V: BTR) announced that Kinross Gold (TSX: K) agreed to acquire 14.9M shares @ C$0.35 each for total gross proceeds of C$5.2M, amounting to 9.5% of BonTerra’s issued and outstanding common shares. BonTerra is exploring several projects including the Gladiator project in Abitibi district in Quebec that has an inferred resource of 905,000t @ 9.37 g/t Au and Larder Lake in Ontario that has an inferred resource of 5.1Mt @ 5.55 g/t Au.

Summary:

- Number of financings dropped to 27, a nine-week low.

- Two brokered financings were announced for $102.8m, a four-week high.

- One bought-deal financings were announced for $98.8m, a seven-week high.

- Total dollars increased to $128.9m, a two-week high.

- Average offer size doubled to $4.7m, a two-week high.

Major Financing Openings:

- PetroShale (TSX-V:PSH) opened a C$70 million offering underwritten by a syndicate led by Haywood Securities on a best efforts basis. The deal is expected to close on or about April 11, 2017.

- Coro Mining (TSX:COP) opened a C$16.2 million offering on a best efforts basis.

- BonTerra Resources (TSX-V:BTR) opened a C$5.2 million offering on a strategic deal basis. The deal is expected to close on or about March 24, 2017.

- TriStar Gold (TSX:TSG) opened a C$4 million offering underwritten by a syndicate led by Echelon Wealth Partners on a best efforts basis. Each unit includes a half warrant that expires in 24 months. The deal is expected to close on or about April 26, 2017.

Major Financing Closings:

- JDL Gold (TSX-V:JDL) closed a C$63.42 million offering on a best efforts basis. Each unit includes a warrant that expires in 57 months.

- Argonaut Gold (TSX:AR) closed a C$45 million offering underwritten by a syndicate led by BMO Capital Markets on a bought deal basis.

- TAG Oil (TSX:TAO) closed a C$15 million offering underwritten by a syndicate led by Mackie Research Capital on a best efforts basis. Each unit includes a half warrant that expires in 24 months.

- Metanor Resources (TSX-V:MTO) closed a C$11.5 million offering underwritten by a syndicate led by Red Cloud Klondike Strike on a best efforts basis.

Company news

Kootenay Silver Inc. (TSXV: KTN) C$0.31, Mkt Cap C$53.3 million

- Approved a budget with Antofagasta (LSE: ANTO), to drill five targets on Kootenay's Silver Fox property in British Columbia. A 3,000m drill program is scheduled to commence during 3Q17.

- Silver Fox comprises over 21,000 hectares covering the northern extension of an established copper-silver mineralized belt originating from Montana, where the three principal deposits either host or produced over 522Moz Ag & 2.39Mt Cu at grades ranging from 1.7-2.0oz/ t Ag & 0.7-0.8% Cu. This mineralized trend is known as the Western Montana Copper Belt.

- Silver Fox covers about 35km kilometres of strike length of the prospective hosting stratigraphy in Canada.

- Under the terms of the JV agreement, Antofagasta has the option to earn up to an 80% interest in Silver Fox.

Kootenay Silver is an exploration company with projects in the Sierra Madre region of Mexico and in British Columbia, Canada. Its leading properties are the La Cigarra silver project and the Promontorio Mineral Belt, in Chihuahua, Mexico and Sonora, Mexico. The Promontorio mineral belt includes the La Negra high-grade silver discovery and its Promontorio silver resource that is under option to Pan American Silver.

Conclusion:

Antofagasta is one of the world’s leading copper mining companies and the decision to start drilling at Silver Fox will test the extension of a proven producing mineralized belt, giving Kootenay the opportunity to benefit from a new discovery with reduced project risk.