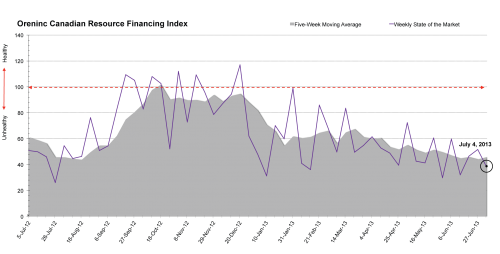

Oreninc Index Falls to Three-Week Low

The Oreninc Index fell to a three-week low for the week ending July 4, 2013. This follows the upward trend of the Index’s two previous weeks. The drop was not a surprise as the week included Canada Day and, in the U.S., Independence Day; overall, North American activity was down. Historically, late July and August are the slowest points of the financing market, leaving no expectations for significant gains until the Fall fundraising season hopefully returns.

Summary:

- Total deals announced fell to 16, a YTD low.

- One brokered deal was announced for $16.8 million, a two-week high.

- One bought deal was announced for $16.8 million, a six-week high.

- Total dollars announced fell to $50 million, a two-week low.

- Average deal size climbed to $3.1 million, a nine-week high.

Major Financing Openings:

- Donnycreek Energy Inc. (TSX-V:DCK) opened a $16.8 million offering underwritten by a syndicate led by RBC Capital Markets on a bought deal basis. The deal is expected to close on or about July 23, 2013.

- Eagle Hill Exploration Corp. (TSX-V:EAG) opened a $12 million offering on a strategic deal basis. Each unit includes a 1/2 warrant that expires in 48 months.

- Adira Energy Ltd. (TSX-V:ADL) opened a $5 million offering on a strategic deal basis.

- KWG Resources Inc. (TSX-V:KWG) opened a $2 million offering on a best efforts basis. Each unit includes 1 warrant that expires in 36 months.

Major Financing Closings:

- Midas Gold Corp. (TSX:MAX) closed a $9.81 million offering on a strategic deal basis.

- Argentex Mining Corporation (TSX-V:ATX) closed a $4.98 million offering on a strategic deal basis. Each unit includes a 1/2 warrant that expires in 60 months.

- Mason Graphite Inc. (TSX-V:LLG) closed a $5 million offering underwritten by a syndicate led by Delano Capital on a best efforts basis. Each unit includes a 1/2 warrant that expires in 24 months.

- Carlisle Goldfields Limited (TSX:CGJ) closed a $1.45 million offering on a best efforts basis.