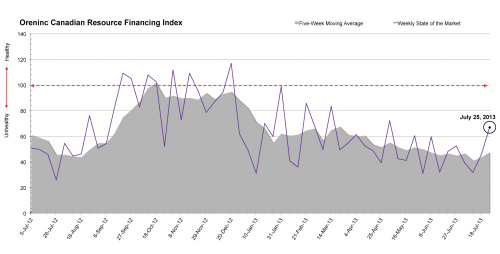

Oreninc Index Climbs to Highest Level Since May

The Oreninc Index rose to its highest level in twelve weeks for the week ending July 25, 2013. The brokered vs. total dollars announced was the highest since January, mostly on the back of Argent Energy Trust’s opening for $75m. Even with the main reason behind the jump being due to one deal, the fact that a company is trying to raise that much through a bought deal shows a small sign of improvement in the financing wasteland that has been Summer 2013.

Summary:

- Total deals announced fell to 28, a one-week low.

- Six brokered deals were announced for $87.3 million dollars, a 12-week high.

- One bought deal was announced for $75 million, a 12-week high.

- Total dollars announced climbed to $68.2 million, a 12-week high.

- Average deal size climbed to $2.4 million, a 16-week high.

Major Financing Openings:

- Argent Energy Trust (TSX:AET.UN) opened a $75.07 million offering underwritten by a syndicate led by Scotiabank on a bought deal basis. The deal is expected to close on or about August 15, 2013.

- Colossus Minerals Inc. (TSX:CSI) opened a $33 million offering underwritten by a syndicate led by GMP Securities L.P. on a best efforts basis. Each unit includes a 1/2 warrant that expires in 24 months. The deal is expected to close on or about August 13, 2013.

- Ascot Resources Ltd. (TSX-V:AOT) opened a $10 million offering on a best efforts basis. Each unit includes 1 warrant that expires in 12 months.

- Gold Standard Ventures Corp. (TSX-V:GV) opened a $5 million offering underwritten by a syndicate led by Macquarie Capital Markets Canada Ltd. on a best efforts basis. The deal is expected to close on or about July 31, 2013.

Major Financing Closings:

- North American Palladium Ltd. (TSX:PDL) closed a $20 million offering on a best efforts basis. The deal was expected to close on or about June 19, 2013.

- True Gold Mining Inc. (TSX-V:TGM) closed a $17.41 million offering on a strategic deal basis.

- Donnycreek Energy Inc. (TSX-V:DCK) closed a $16.8 million offering underwritten by a syndicate led by RBC Capital Markets on a bought deal basis. The deal was expected to close on or about July 23, 2013.

- Stonegate Agricom Ltd. (TSX:ST) closed a $10 million offering underwritten by a syndicate led by GMP Securities L.P. on a best efforts basis. The deal was expected to close on or about July 24, 2013.