Oreninc Index Update: February 27, 2017

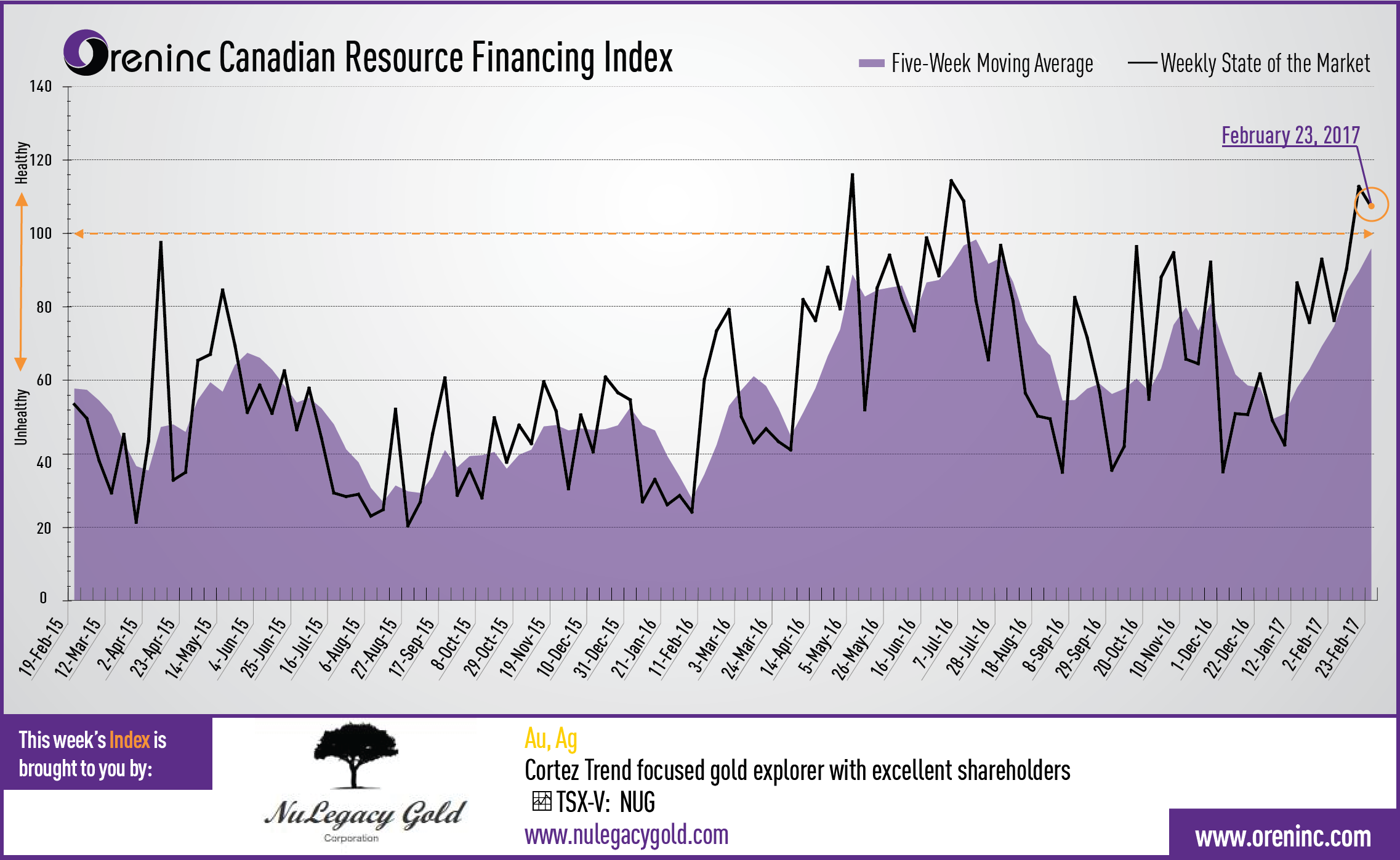

ORENINC INDEX stays over 100 as gold strengthens

ORENINC INDEX - Monday, February 27, 2017

North America’s leading junior mining finance data provider

Follow us on facebook and find us on Twitter @Oreninc

Prospero Silver Corp. (TSXV: PSL): Bermudez is drill ready

Last week index score: 112.76

This week: 107.24

The Oreninc Index pulled back in the week ending February 23, 2017 to 107.24 from 112.76 the previous week, whilst remaining over 100. Gold had a strong week closing at $1,249 USD, meaning gold has risen 4.68% in the last thirty days.

Total fund raising dollars announced fell slightly to C$175.3m from C$184.5m, which included 8 brokered financings for a total of C$95.1m within which were six bought-deal financings for C$75.2m. However, the average offer size increased from $2.7m to $3.5m, whilst the total number of financings announced pulled back sharply to 50 from 68.

Whilst the gold price had a strong week, the industry’s leading benchmark index, the van Eck managed GDXJ pulled back sharply and is now up 27.07% so far in 2017. However, the SPDR GLD ETF gold inventory remained at 841.17 tonnes, its highest volume since December 16, 2016.

The copper price continued to soften to close at $2.69 per pound despite a strike continuing at Escondida, the world’s largest copper mine that produces about 1.1 million tonnes a year of copper, some 5% of the world’s copper production.

The Dow Jones Industrial Average continued to plough ahead in record territory closing the week at 20,821, marking ten-days straight of breaking records, which seemed to hot a pace for the S&P/TSX Composite Index to keep as it fell back to 15,533.

Canadian bank BMO is hosting its Metals and Mining event this week which sees major miners and advanced exploration company do speed dating with fund managers, so it is likely that new private placements and bought deals will be announced as a result of this in the weeks ahead.

Financial news highlights

Argonaut Gold Inc. (TSX:AR) opened a $40.08 million offering underwritten by a syndicate led by BMO Capital Markets on a bought deal basis. The net proceeds will be used for the acquisition of 420 hectares of properties adjacent to the El Castillo Mine from Fresnillo Plc that cover known projections of El Castillo mineralization. Argonaut agreed to pay $26 million in cash for the concessions. El Castillo produces over 70,000 ounces a year of gold.

With the copper price showing signs of life in recent months Highland Copper Company Inc. (TSX-V:HI) has repeatedly extended a US$17 million non-brokered private placement originally announced in November until March 17th. Highland will use the proceeds to update the feasibility of the Copperwood project, to complete the acquisition of the White Pine project, to settle its liabilities and for general corporate purposes.

Once again money is being raised for lithium, this time with Lithium X Energy Corp. (TSX-V:LIX) seeking $15.01 million underwritten by a syndicate led by Canaccord Genuity Corp. on a bought deal basis for exploration and development work on the Sal de Los Angeles lithium project in Salta, Argentina.

Summary:

- Number of financings decreased to 50, a two-week low

- Eight brokered financings were announced for $95.1m, a three-week low.

- Six bought-deal financings were announced for $75.2m, a three-week low.

- Total dollars lowered to $175.3m, a two-week low.

- Average offer size increased to $3.5m, a two-week high.

Major Financing Openings:

- Argonaut Gold Inc. (TSX:AR) opened a $40.08 million offering underwritten by a syndicate led by BMO Capital Markets on a bought deal basis. The deal is expected to close on or about March 15, 2017.

- Ascendant Resources Inc. (TSX-V:ASND) opened a $17.43 million offering underwritten by a syndicate led by Eight Capital on a best efforts basis. The deal is expected to close on or about March 7, 2017.

- IDM Mining Ltd. (TSX:IDM) opened a $15.25 million offering on a strategic deal basis. The deal is expected to close on or about March 1, 2017.

- Lithium X Energy Corp. (TSX-V:LIX) opened a $15.01 million offering underwritten by a syndicate led by Canaccord Genuity Corp. on a bought deal basis. The deal is expected to close on or about March 14, 2017.

Major Financing Closings:

- Neo Lithium Corp. (TSX-V:NLC) closed a $25.01 million offering underwritten by a syndicate led by Sprott Capital Partners on a bought deal basis.

- Red Eagle Mining Corp. (TSX:R.TO) closed a $17.25 million offering underwritten by a syndicate led by BMO Capital Markets on a bought deal basis.

- Erdene Resource Development Corp. (TSX:ERD) closed a $13.8 million offering underwritten by a syndicate led by Paradigm Capital Inc. on a bought deal basis.

Company news

Prospero Silver Corp (TSXV: PSL) C$0.27, Mkt Cap C$2.47 million

- Completed additional sampling and mapping at the Bermudez project in Chihuahua, Mexico and has now completed mapping and sampling over 4.5km strike length of outcropping high-level banded, low-sulphidation veins.

- Designed a preliminary diamond drill program to test the three zones.

- Begins to look for a joint venture partner for Bermudez.

Prospero is a project generator focused on Mexico and with the low sulphidation epithermal vein system traced over 4.5km at Bermudez, the project is now drill ready and the ideal time for the company to seek a joint venture partner to fund the drilling program.

Conclusion: Prospero has successfully migrated Bermudez from a prospect to drill ready status that is ready for a joint venture partner.

Comments