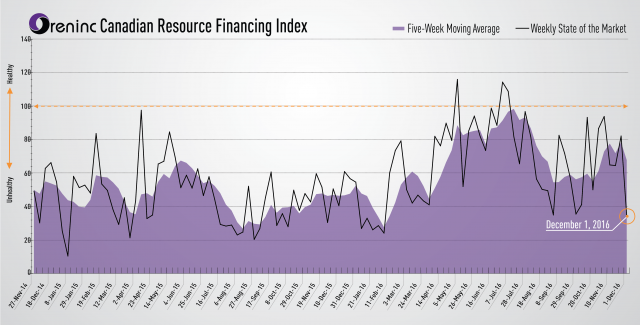

12/01 - Oreninc Index Falls to 10-Month Low

Oreninc Index Falls to 10-Month Low

The Oreninc Index fell to it’s lowest level in almost 10 months for the week ending December 1, 2016. Total dollars announced fell to $43.4m, a 35-week low. Three brokered financings were announced for $4.0m, a 29-week low; No bought-deal financings were announced, a six-week low.

The biggest deal-making news of the week came from the Brazilian Miner Vale (NYSE:VALE), which gave indications to investors that they may not be selling off $10bn of their core assets, as they had announced back in February, due to a stronger than expected financial performance in 2016. Metal prices had an up and down week, with iron ore swinging around wildly due to increased trading fees for the metal, along with positive chinese manufacturing data. Gold similarly had an up-and-down week, ultimately ending down.

While it’s never good to see a low like the index has seen this week, given the Thanksgiving holiday in the US and the fact that the five-week moving average only fell to a five-week low, we still have a while until we have to be concerned for the health of the market. Still, something to look out for is decreased financing activity over the next month as bankers and geologists alike gear up for their holiday vacations.

Summary:

Number of financings drop to 27, a six-week high.

Three brokered financings were announced for $4.0m, a 29-week low.

No bought-deal financings were announced, a six-week low.

Total dollars fell to $43.4m, a 35-week low.

Average offer size decreased to $1.6m, a 29-week low.

Major Financing Openings:

- Adriana Resources Inc. (TSX-V:ADI) opened a $15 million offering on a strategic deal basis.

- NGEx Resources Inc. (TSX:NGQ) opened a $10 million offering on a best efforts basis.

- GoviEx Uranium Inc. (CSE:GXU) opened a $3 million offering underwritten by a syndicate led by Sprott group of companies on a best efforts basis. Each unit includes 1 warrant that expires in 60 months.

- Claren Energy Corp. (TSX-V:CEN) opened a $2 million offering on a best efforts basis. Each unit includes 1 warrant that expires in 24 months.

Major Financing Closings:

- Timmins Gold Corp. (TSX:TMM) closed a $20.02 million offering underwritten by a syndicate led by National Bank Financial Inc. on a bought deal basis. Each unit includes a 1/2 warrant that expires in 18 months. The deal is expected to close on or about November 30, 2016.

- Manitok Energy Inc. (TSX-V:MEI) closed a $4.41 million offering underwritten by a syndicate led by Integral Wealth Securities Ltd. on a best efforts basis. The deal is expected to close on or about November 29, 2016.

- ML Gold Corp. (TSX-V:MLG) closed a $2.22 million offering on a best efforts basis. Each unit includes a 1/2 warrant that expires in 24 months.

- Strongbow Exploration Inc. (TSX-V:SBW) closed a $1.97 million offering on a best efforts basis.

Comments